Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given: Retirement benefits: Normal retirement age: Form of benefit payment: Employee contributions: Vesting: Termination benefit: 2.0% of final year's earnings times years

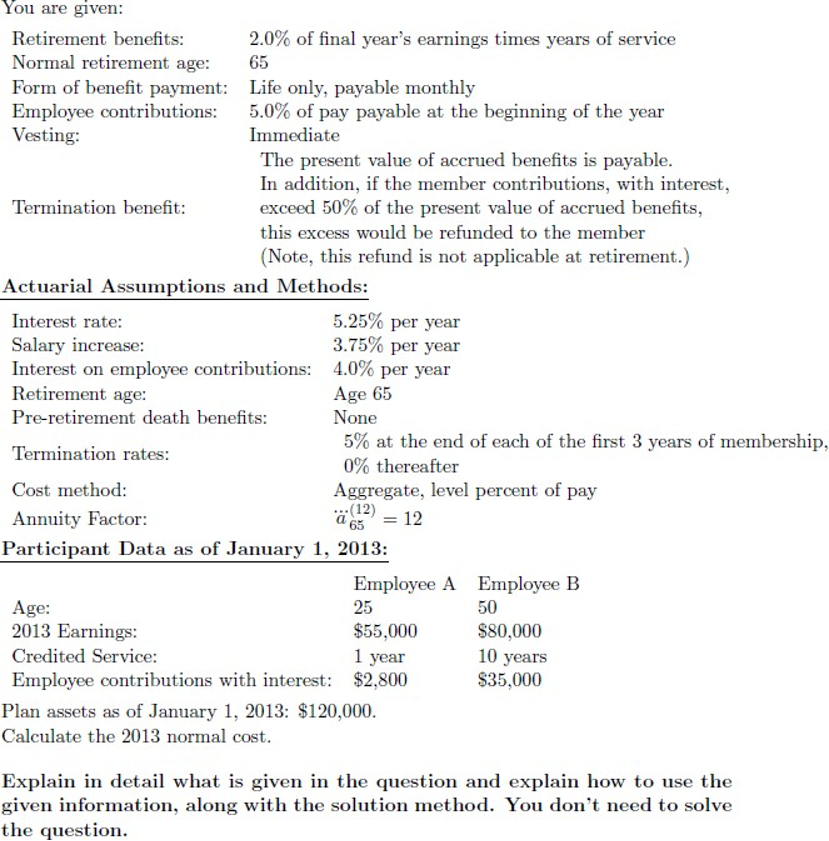

You are given: Retirement benefits: Normal retirement age: Form of benefit payment: Employee contributions: Vesting: Termination benefit: 2.0% of final year's earnings times years of service 65 Life only, payable monthly 5.0% of pay payable at the beginning of the year Immediate The present value of accrued benefits is payable. In addition, if the member contributions, with interest, exceed 50% of the present value of accrued benefits, this excess would be refunded to the member (Note, this refund is not applicable at retirement.) Actuarial Assumptions and Methods: Interest rate: Salary increase: 5.25% per year 3.75% per year Interest on employee contributions: 4.0% per year Retirement age: Pre-retirement death benefits: Termination rates: Cost method: Annuity Factor: Age 65 None 5% at the end of each of the first 3 years of membership, 0% thereafter Aggregate, level percent of pay ...(12) a 65 = 12 Participant Data as of January 1, 2013: Employee A Employee B Age: 2013 Earnings: Credited Service: 25 50 $55,000 $80,000 1 year 10 years $2,800 $35,000 Employee contributions with interest: Plan assets as of January 1, 2013: $120,000. Calculate the 2013 normal cost. Explain in detail what is given in the question and explain how to use the given information, along with the solution method. You don't need to solve the question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started