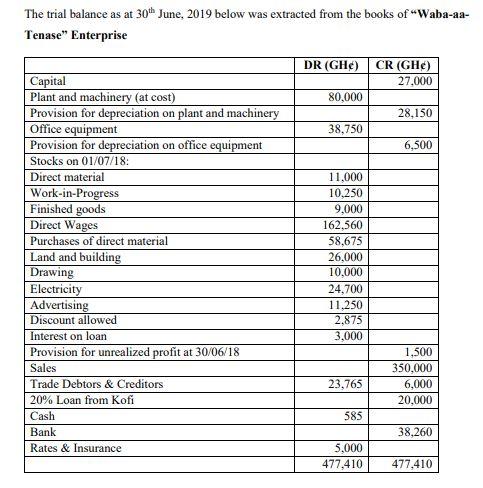

Question

You are given the following additional information: a. Stocks on 30/06/19 were: Direct material = GH 7,500 W-I-P = GH10,275 Finished goods = GH 8,250

You are given the following additional information: a. Stocks on 30/06/19 were:

Direct material = GH 7,500 W-I-P = GH10,275 Finished goods = GH 8,250

b. Depreciation is to be provided on cost at the following rates:

plant and machinery = 10%; office equipment = 20%

c. Mr. Abban, the owner, took the following goods for his personal use: Direct material = GH2,500 Finished goods = GH3,000

d. Common expenses are to be allocated as follows: ELECTRICITY

Manufacturing = 70%

Administration = 30%

RATES AND INSURANCE

Manufacturing = 80%

Administration = 20% WAGES

Manufacturing = 6/10

Administration = 4/10

e. Goods are transferred to trading department at a mark-up of 20%.

You are required to prepare the manufacturing income statement for the year ended 30th June 2019 as well as the statement of financial position as at that date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started