Answered step by step

Verified Expert Solution

Question

1 Approved Answer

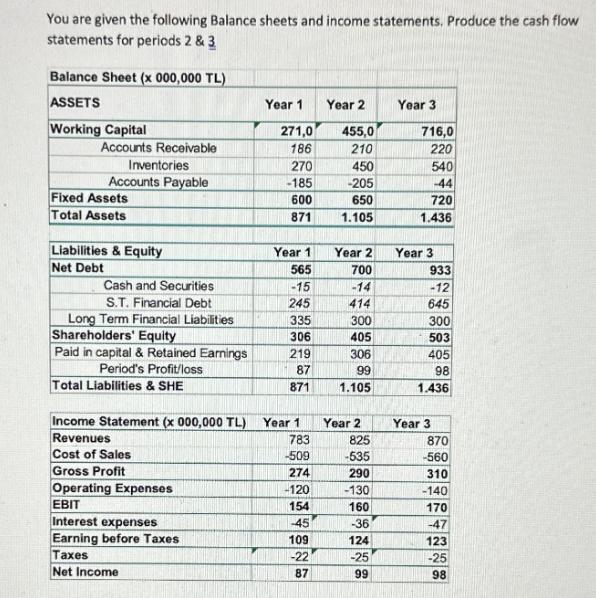

You are given the following Balance sheets and income statements. Produce the cash flow statements for periods 2 & 3 Balance Sheet (x 000,000

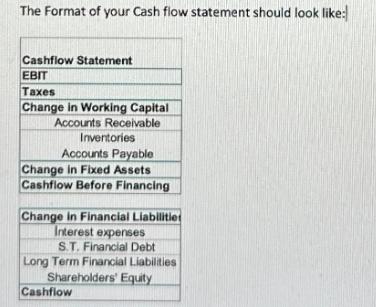

You are given the following Balance sheets and income statements. Produce the cash flow statements for periods 2 & 3 Balance Sheet (x 000,000 TL) ASSETS Working Capital Accounts Receivable Inventories Accounts Payable Fixed Assets Total Assets Liabilities & Equity Net Debt Cash and Securities S.T. Financial Debt Long Term Financial Liabilities Shareholders' Equity Paid in capital & Retained Earnings Period's Profit/loss Total Liabilities & SHE Income Statement (x 000,000 TL) Revenues Cost of Sales Gross Profit Operating Expenses EBIT Interest expenses Earning before Taxes. Taxes Net Income Year 1 Year 2 271,0 186 270 -185 600 871 Year 1 565 -15 245 335 306 219 87 871 Year 1 783 -509 274 -120 154 -45 109 -22 87 455,0 210 450 -205 650 1.105 Year 2 700 -14 414 300 405 306 99 1.105 Year 2 825 -535 290 -130 160 -36 124 -25 99 Year 3 716,0 220 540 -44 720 1.436 Year 3 933 -12 645 300 503 405 98 1.436 Year 3 870 -560 310 -140 170 -47 123 -25 98 The Format of your Cash flow statement should look like: Cashflow Statement EBIT Taxes Change in Working Capital Accounts Receivable Inventories Accounts Payable Change in Fixed Assets Cashflow Before Financing Change in Financial Liabilitie Interest expenses S.T. Financial Debt Long Term Financial Liabilities Shareholders' Equity Cashflow

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Cash Flow Statement Year 2 Cashflow Statement EBIT 160 Taxes 25 Change in Working Capital 455 271 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started