Answered step by step

Verified Expert Solution

Question

1 Approved Answer

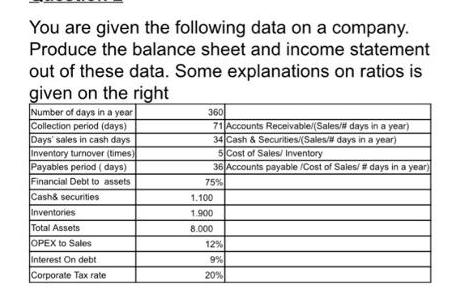

You are given the following data on a company. Produce the balance sheet and income statement out of these data. Some explanations on ratios

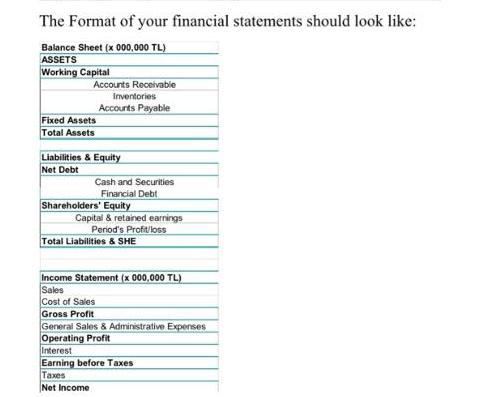

You are given the following data on a company. Produce the balance sheet and income statement out of these data. Some explanations on ratios is given on the right Number of days in a year Collection period (days) Days' sales in cash days Inventory turnover (times) Payables period (days) Financial Debt to assets Cash& securities Inventories Total Assets OPEX to Sales Interest On debt Corporate Tax rate 360 71 Accounts Receivable/(Sales/## days in a year) 34 Cash & Securities/(Sales/# days in a year) 5 Cost of Sales/ Inventory 36 Accounts payable /Cost of Sales/ # days in a year) 75% 1.100 1.900 8.000 12% 9% 20% The Format of your financial statements should look like: Balance Sheet (x 000,000 TL) ASSETS Working Capital Accounts Receivable Fixed Assets Total Assets Inventories Accounts Payable Liabilities & Equity Net Debt Cash and Securities Financial Debt Shareholders' Equity Capital & retained earnings Period's Profit/loss Total Liabilities & SHE Income Statement (x 000,000 TL) Sales Cost of Sales Gross Profit General Sales & Administrative Expenses Operating Profit Interest Earning before Taxes Taxes Net Income You are given the following data on a company. Produce the balance sheet and income statement out of these data. Some explanations on ratios is given on the right Number of days in a year Collection period (days) Days' sales in cash days Inventory turnover (times) Payables period (days) Financial Debt to assets Cash& securities Inventories Total Assets OPEX to Sales Interest On debt Corporate Tax rate 360 71 Accounts Receivable/(Sales/## days in a year) 34 Cash & Securities/(Sales/# days in a year) 5 Cost of Sales/ Inventory 36 Accounts payable /Cost of Sales/ # days in a year) 75% 1.100 1.900 8.000 12% 9% 20% The Format of your financial statements should look like: Balance Sheet (x 000,000 TL) ASSETS Working Capital Accounts Receivable Fixed Assets Total Assets Inventories Accounts Payable Liabilities & Equity Net Debt Cash and Securities Financial Debt Shareholders' Equity Capital & retained earnings Period's Profit/loss Total Liabilities & SHE Income Statement (x 000,000 TL) Sales Cost of Sales Gross Profit General Sales & Administrative Expenses Operating Profit Interest Earning before Taxes Taxes Net Income

Step by Step Solution

★★★★★

3.23 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To create the balance sheet and income statement from the given data we need to calculate certain fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started