Answered step by step

Verified Expert Solution

Question

1 Approved Answer

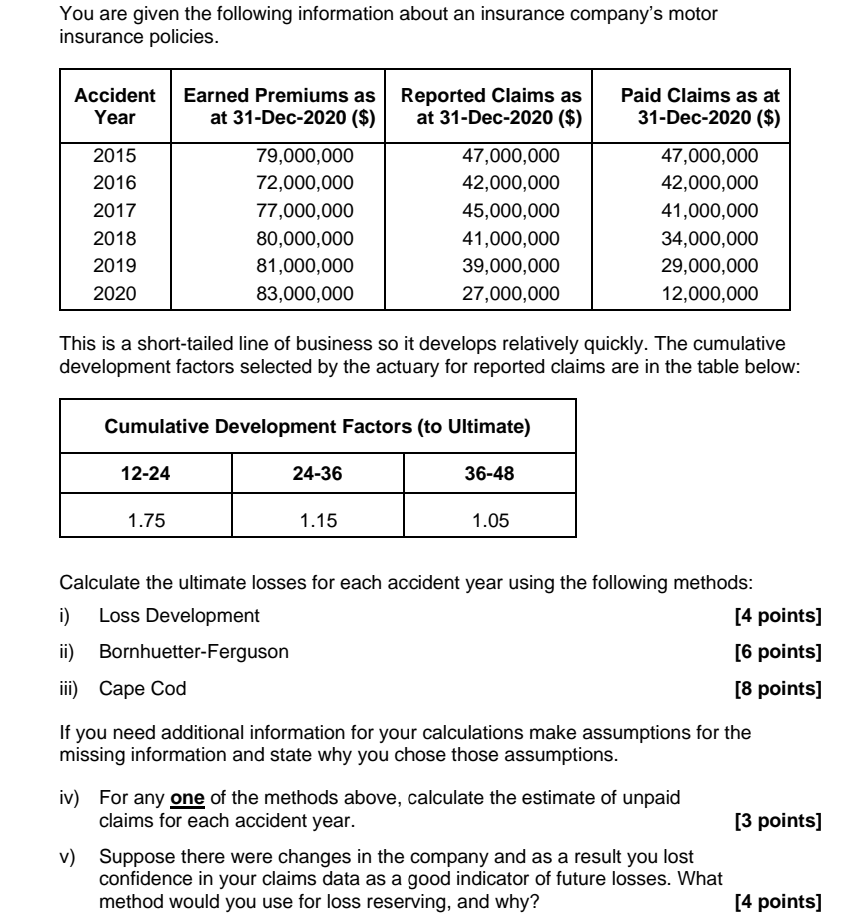

You are given the following information about an insurance company's motor insurance policies. Accident Year Earned Premiums as Reported Claims as at 31-Dec-2020 ($) at

You are given the following information about an insurance company's motor insurance policies. Accident Year Earned Premiums as Reported Claims as at 31-Dec-2020 ($) at 31-Dec-2020 ($) Paid Claims as at 31-Dec-2020 ($) 2015 2016 2017 2018 2019 2020 79,000,000 72,000,000 77,000,000 80,000,000 81,000,000 83,000,000 47,000,000 42,000,000 45,000,000 41,000,000 39,000,000 27,000,000 47,000,000 42,000,000 41,000,000 34,000,000 29,000,000 12,000,000 This is a short-tailed line of business so it develops relatively quickly. The cumulative development factors selected by the actuary for reported claims are in the table below: Cumulative Development Factors (to Ultimate) 12-24 24-36 36-48 1.75 1.15 1.05 Calculate the ultimate losses for each accident year using the following methods: i) Loss Development [4 points] ii) Bornhuetter-Ferguson [6 points] iii) Cape Cod [8 points) If you need additional information for your calculations make assumptions for the missing information and state why you chose those assumptions. [3 points) iv) For any one of the methods above, calculate the estimate of unpaid claims for each accident year. v) Suppose there were changes in the company and as a result you lost confidence in your claims data as a good indicator of future losses. What method would you use for loss reserving, and why? [4 points] You are given the following information about an insurance company's motor insurance policies. Accident Year Earned Premiums as Reported Claims as at 31-Dec-2020 ($) at 31-Dec-2020 ($) Paid Claims as at 31-Dec-2020 ($) 2015 2016 2017 2018 2019 2020 79,000,000 72,000,000 77,000,000 80,000,000 81,000,000 83,000,000 47,000,000 42,000,000 45,000,000 41,000,000 39,000,000 27,000,000 47,000,000 42,000,000 41,000,000 34,000,000 29,000,000 12,000,000 This is a short-tailed line of business so it develops relatively quickly. The cumulative development factors selected by the actuary for reported claims are in the table below: Cumulative Development Factors (to Ultimate) 12-24 24-36 36-48 1.75 1.15 1.05 Calculate the ultimate losses for each accident year using the following methods: i) Loss Development [4 points] ii) Bornhuetter-Ferguson [6 points] iii) Cape Cod [8 points) If you need additional information for your calculations make assumptions for the missing information and state why you chose those assumptions. [3 points) iv) For any one of the methods above, calculate the estimate of unpaid claims for each accident year. v) Suppose there were changes in the company and as a result you lost confidence in your claims data as a good indicator of future losses. What method would you use for loss reserving, and why? [4 points]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started