Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following information about your firm: 1. Your firm currently has 10 -year debt outstanding that pays interest of $30 every six

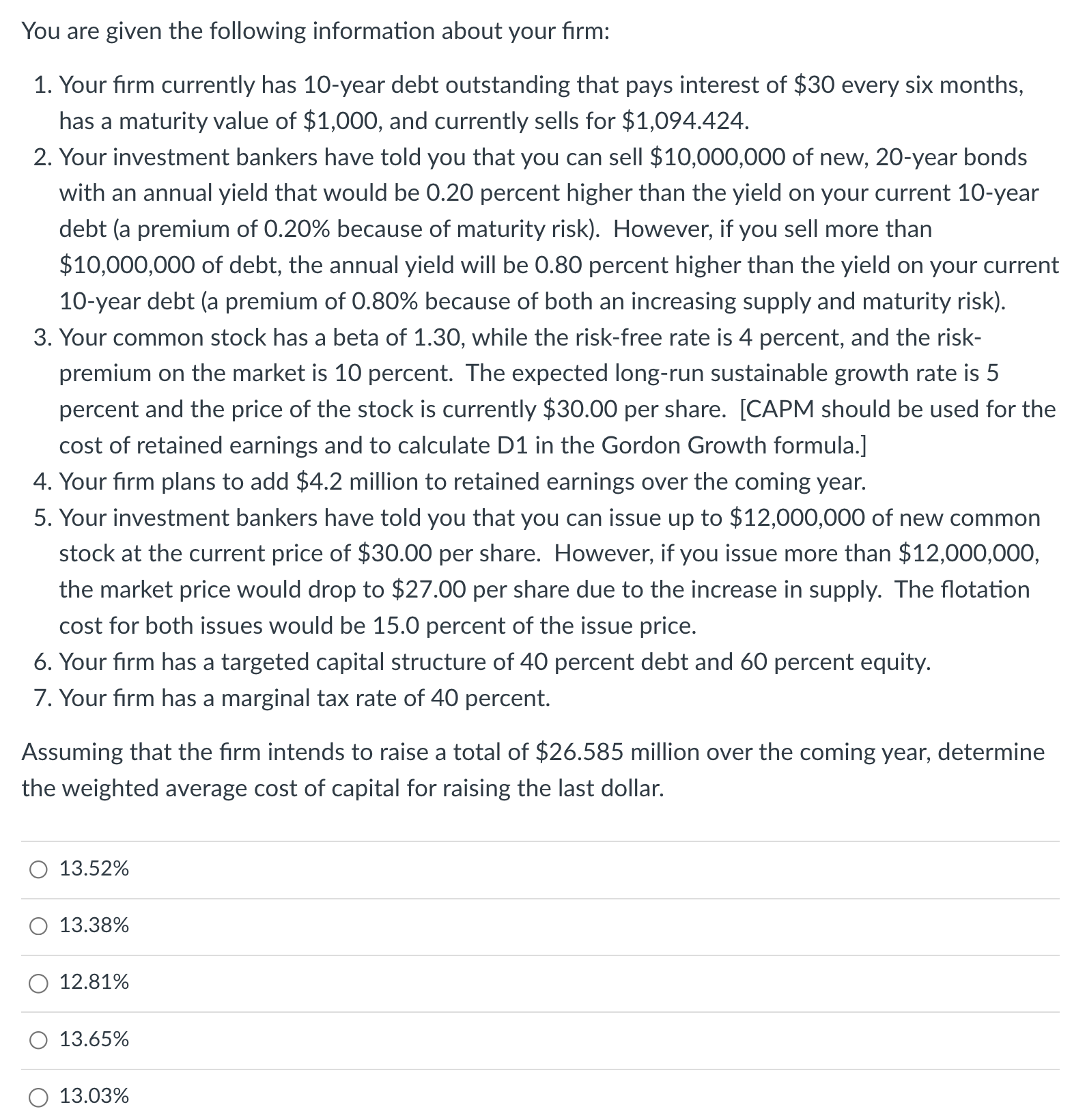

You are given the following information about your firm: 1. Your firm currently has 10 -year debt outstanding that pays interest of $30 every six months, has a maturity value of $1,000, and currently sells for $1,094.424. 2. Your investment bankers have told you that you can sell $10,000,000 of new, 20-year bonds with an annual yield that would be 0.20 percent higher than the yield on your current 10 -year debt (a premium of 0.20% because of maturity risk). However, if you sell more than $10,000,000 of debt, the annual yield will be 0.80 percent higher than the yield on your current 10 -year debt (a premium of 0.80% because of both an increasing supply and maturity risk). 3. Your common stock has a beta of 1.30 , while the risk-free rate is 4 percent, and the riskpremium on the market is 10 percent. The expected long-run sustainable growth rate is 5 percent and the price of the stock is currently $30.00 per share. [CAPM should be used for the cost of retained earnings and to calculate D1 in the Gordon Growth formula.] 4. Your firm plans to add $4.2 million to retained earnings over the coming year. 5. Your investment bankers have told you that you can issue up to $12,000,000 of new common stock at the current price of $30.00 per share. However, if you issue more than $12,000,000, the market price would drop to $27.00 per share due to the increase in supply. The flotation cost for both issues would be 15.0 percent of the issue price. 6. Your firm has a targeted capital structure of 40 percent debt and 60 percent equity. 7. Your firm has a marginal tax rate of 40 percent. Assuming that the firm intends to raise a total of $26.585 million over the coming year, determine the weighted average cost of capital for raising the last dollar. 13.52% 13.38% 12.81% 13.65% 13.03%

You are given the following information about your firm: 1. Your firm currently has 10 -year debt outstanding that pays interest of $30 every six months, has a maturity value of $1,000, and currently sells for $1,094.424. 2. Your investment bankers have told you that you can sell $10,000,000 of new, 20-year bonds with an annual yield that would be 0.20 percent higher than the yield on your current 10 -year debt (a premium of 0.20% because of maturity risk). However, if you sell more than $10,000,000 of debt, the annual yield will be 0.80 percent higher than the yield on your current 10 -year debt (a premium of 0.80% because of both an increasing supply and maturity risk). 3. Your common stock has a beta of 1.30 , while the risk-free rate is 4 percent, and the riskpremium on the market is 10 percent. The expected long-run sustainable growth rate is 5 percent and the price of the stock is currently $30.00 per share. [CAPM should be used for the cost of retained earnings and to calculate D1 in the Gordon Growth formula.] 4. Your firm plans to add $4.2 million to retained earnings over the coming year. 5. Your investment bankers have told you that you can issue up to $12,000,000 of new common stock at the current price of $30.00 per share. However, if you issue more than $12,000,000, the market price would drop to $27.00 per share due to the increase in supply. The flotation cost for both issues would be 15.0 percent of the issue price. 6. Your firm has a targeted capital structure of 40 percent debt and 60 percent equity. 7. Your firm has a marginal tax rate of 40 percent. Assuming that the firm intends to raise a total of $26.585 million over the coming year, determine the weighted average cost of capital for raising the last dollar. 13.52% 13.38% 12.81% 13.65% 13.03% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started