Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following information about zero-coupon bonds with different maturities. All of these bonds have $1,000 face value: Bond Maturity Bond A

Â

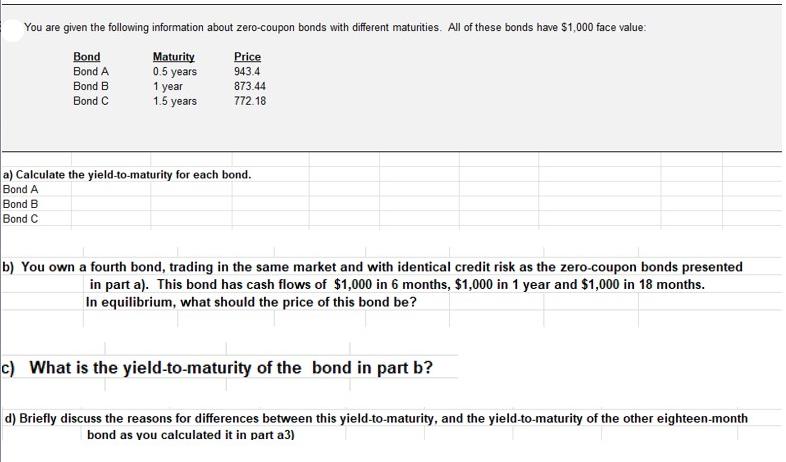

You are given the following information about zero-coupon bonds with different maturities. All of these bonds have $1,000 face value: Bond Maturity Bond A 0.5 years Bond B 1 year Bond C 1.5 years Price 943.4 873.44 772.18 a) Calculate the yield-to-maturity for each bond. Bond A Bond B Bond C b) You own a fourth bond, trading in the same market and with identical credit risk as the zero-coupon bonds presented in part a). This bond has cash flows of $1,000 in 6 months, $1,000 in 1 year and $1,000 in 18 months. In equilibrium, what should the price of this bond be? c) What is the yield-to-maturity of the bond in part b? d) Briefly discuss the reasons for differences between this yield-to-maturity, and the yield-to-maturity of the other eighteen-month bond as you calculated it in part a3)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the yieldtomaturity YTM for each bond we can use the formula YTM Face Value Price1 Maturity 1 Lets calculate the YTM for each bond Bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started