Answered step by step

Verified Expert Solution

Question

1 Approved Answer

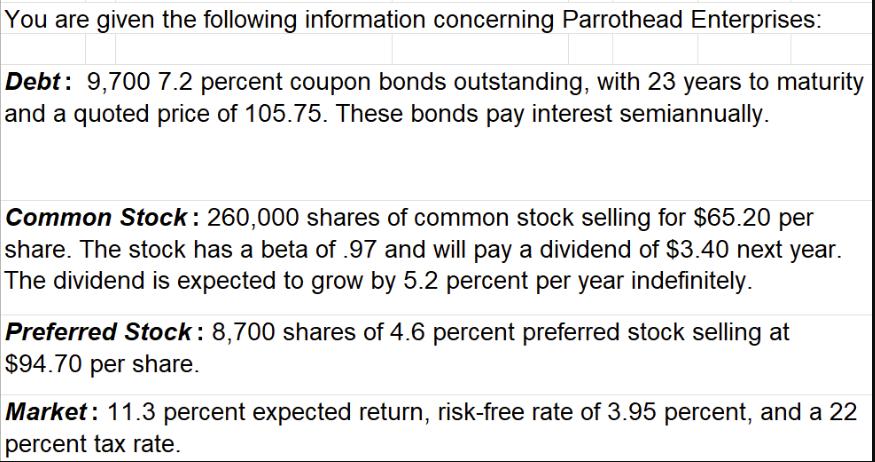

You are given the following information concerning Parrothead Enterprises: Debt: 9,700 7.2 percent coupon bonds outstanding, with 23 years to maturity and a quoted

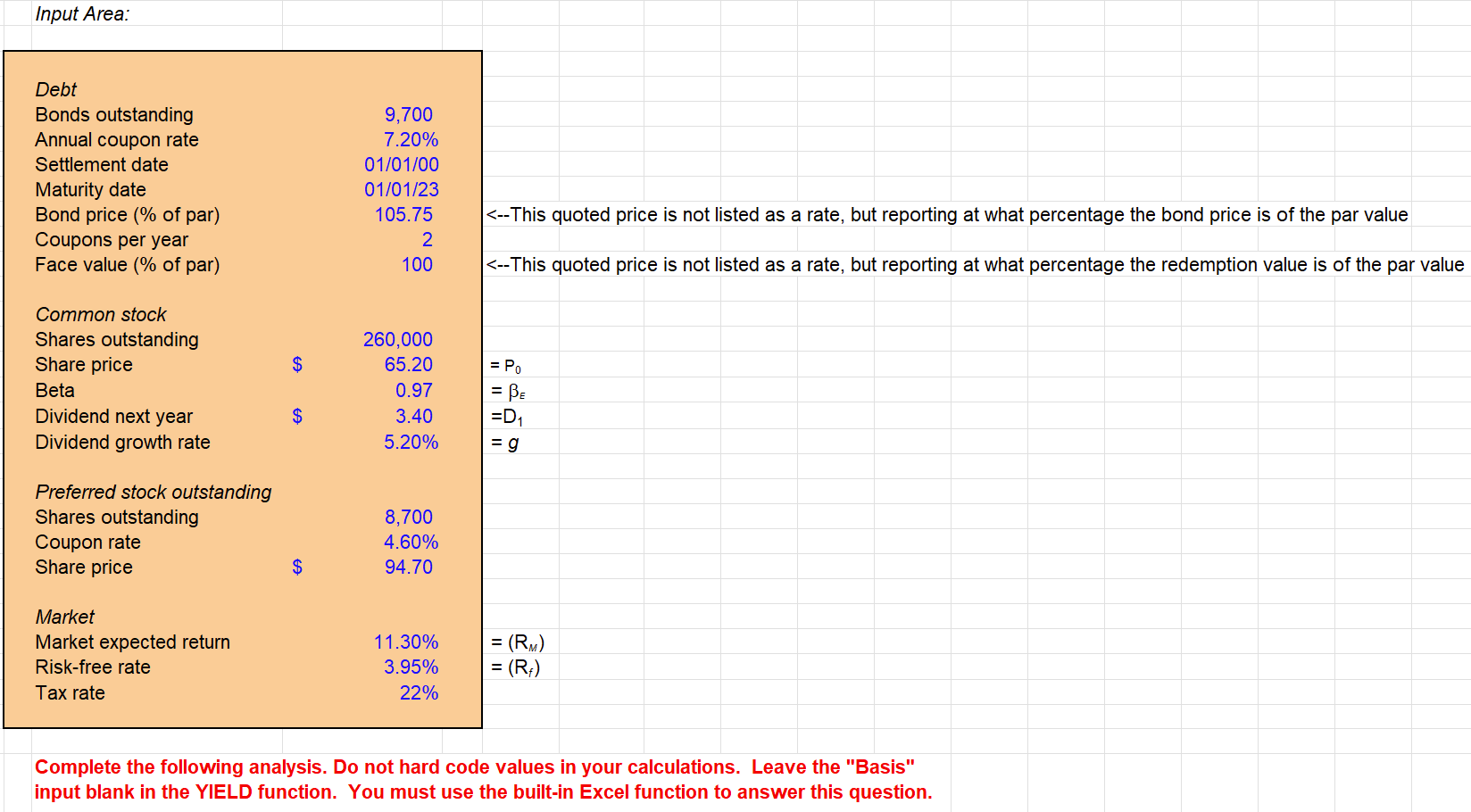

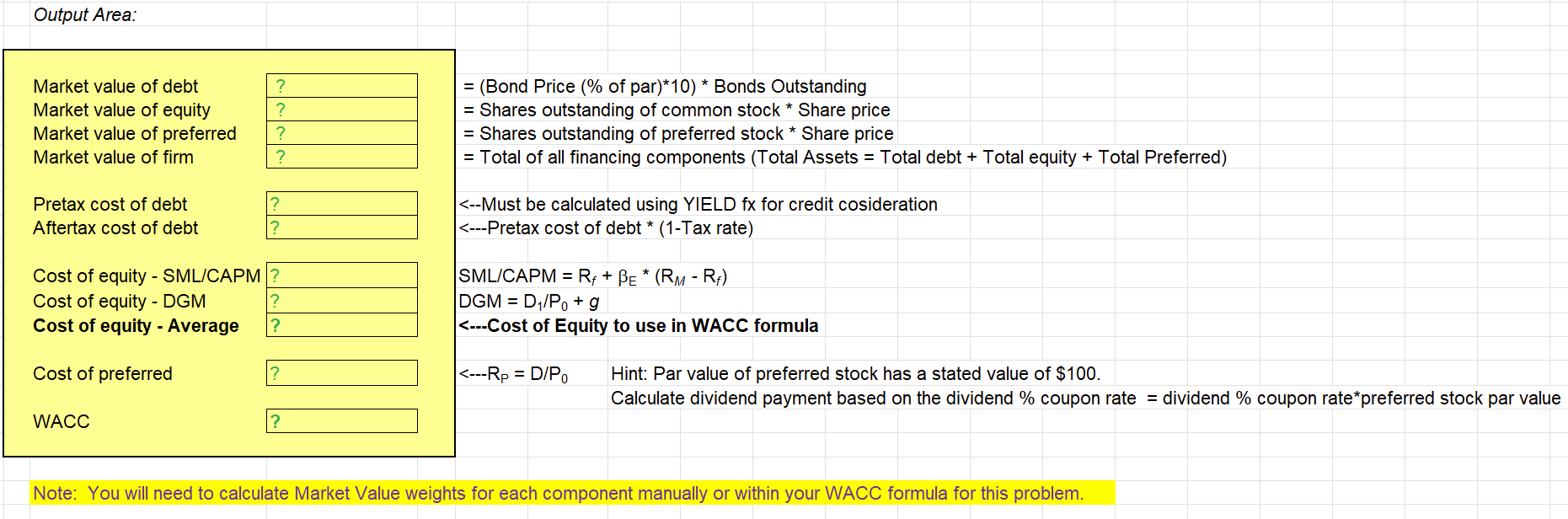

You are given the following information concerning Parrothead Enterprises: Debt: 9,700 7.2 percent coupon bonds outstanding, with 23 years to maturity and a quoted price of 105.75. These bonds pay interest semiannually. Common Stock: 260,000 shares of common stock selling for $65.20 per share. The stock has a beta of .97 and will pay a dividend of $3.40 next year. The dividend is expected to grow by 5.2 percent per year indefinitely. Preferred Stock: 8,700 shares of 4.6 percent preferred stock selling at $94.70 per share. Market: 11.3 percent expected return, risk-free rate of 3.95 percent, and a 22 percent tax rate. Input Area: Debt Bonds outstanding Annual coupon rate Settlement date Maturity date Bond price (% of par) Coupons per year Face value (% of par) Common stock Shares outstanding Share price Beta Dividend next year Dividend growth rate Preferred stock outstanding Shares outstanding Coupon rate Share price Market Market expected return Risk-free rate Tax rate $ $ $ 9,700 7.20% 01/01/00 01/01/23 105.75 2 100 260,000 65.20 0.97 3.40 5.20% 8,700 4.60% 94.70 11.30% 3.95% 22% Output Area: Market value of debt Market value of equity Market value of preferred Market value of firm Pretax cost of debt Aftertax cost of debt ? ? ? ? WACC ? ? Cost of equity - SML/CAPM? Cost of equity - DGM Cost of equity - Average Cost of preferred ? ? ? ? = (Bond Price (% of par)*10) * Bonds Outstanding = Shares outstanding of common stock * Share price = Shares outstanding of preferred stock * Share price = Total of all financing components (Total Assets = Total debt + Total equity + Total Preferred)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 The first step is to find the cost of the individual sources of capita...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started