Question

You are given the following information concerning two stocks that make up an index. Assume that the divisor is 2. What is the percentage return

You are given the following information concerning two stocks that make up an index. Assume that the divisor is 2. What is the percentage return for the price-weighted index?

| Shares Outstanding | Beginning of Year Price | End of year Price | |

| Kirk, Inc. | 45,000 | $81 | 91 |

| Picard C. | 60,000 | 41 | 47 |

QUESTION 2

Suppose there are only two stocks in the market and the following information is given:

| Shares Outstanding | Beginning of Year Price | End of year Price | |

| Ally Co. | 100 million | $60 | $66 |

| McBeal, Inc. | 400 million | 126 | 100 |

Suppose that McBeal splits 3-for-1. Based on beginning information, what is the new divisor?

Based on beginning information, what is the new divisor? (Note: Before the split, the divisor is 2. Round your answer to four decimal places.)

QUESTION 3

You are given the following information concerning two stocks that make up an index. What is the percentage value-weighted return for the index?

| Shares Outstanding | Beginning of Year Price | End of year Price | |

| Kirk, Inc. | 41,000 | $88 | $93 |

| Picard Co. | 63,000 | 44 | 54 |

QUESTION 4

You are given the following information concerning two stocks that make up an index. Assume the value-weighted index level was 419.59 at the beginning of the year. What is the index level at the end of the year?

Shares Outstanding Beginning of Year Price End of year Price

Kirk, Inc. 40,000 $84 $90

Picard Co. 56,000 42 46

2 points

QUESTION 5

On August 30, 2010, the DJIA closed at 10,456.74. The divisor at that time was 0.12015025. What would the new index level be if all stocks on the DJIA increased by $3.00 per share on August 31, 2010?.

QUESTION 6

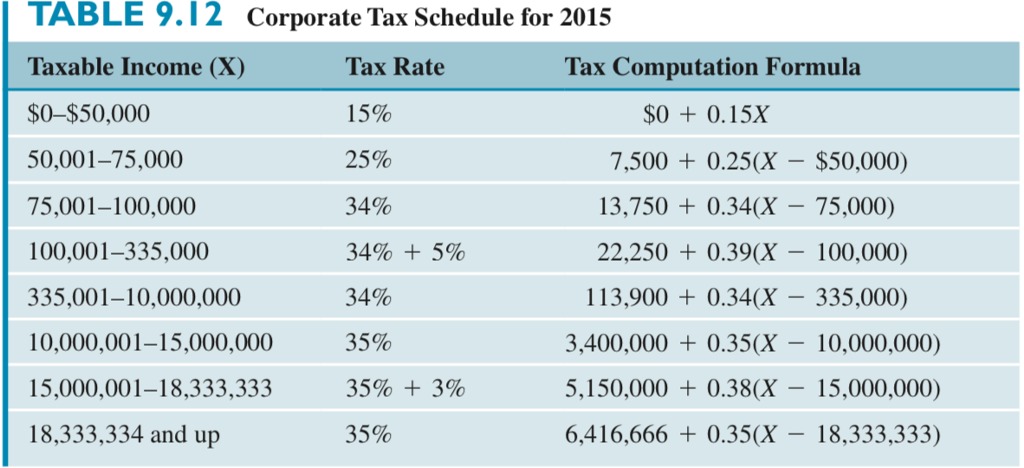

Florida Citrus Inc. (FCI) estimates its taxable income at $5,700,000. The company is considering expanding its product line by introducing a low-calorie sport drink for next year. It expects that the additional taxable income next year from this sport drink will be $700,000. Use the Corporate Tax Schedule, Table 9.12, to compute the difference in the after-tax net income between producing the low-calorie sport drink and not producing the low-calorie sport drink. Enter your answer as a positive number."

TABLE 9.12 Corporate Tax Schedule for 2015 Taxable Income (X) $0-$50,000 50,001-75,000 75,001-100,000 100,001-335,000 335,001-10,000,000 10,000,001-15,000,000 15,000,001-18,333,333 18,333,334 and up Tax Rate 15% 25% 34% 34% + 5% 34% 35% 35% +3% 35% Tax Computation Formula $0+ 0.15X 7,500+ 0.25(X $50,000) 13,750 +0.34(X - 75,000) 22,250+ 0.39(X 100,000) 113,900+ 0.34(X - 335,000) 3,400,000+ 0.35(X 5,150,000+ 0.38(X 6,416,666 +0.35(X - - - - 10,000,000) 15,000,000) 18,333,333)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Question 2 The new divisor would be 2 400 million 400 million 100 million 400 million 2 800 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started