Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are given the following information for a replacement project for machines. Each machine currently in use has a net book value of $ 1

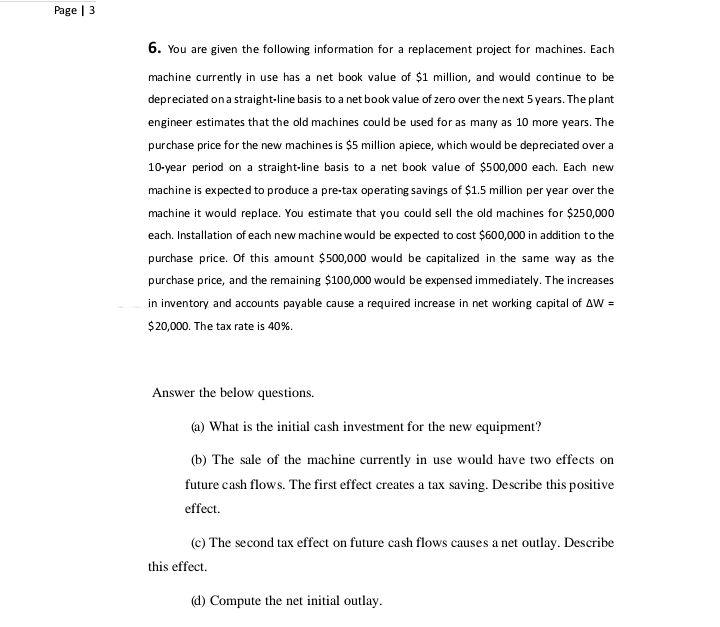

You are given the following information for a replacement project for machines. Each

machine currently in use has a net book value of $ million, and would continue to be

depreciated on a straightline basis to a net book value of zero over the next years. The plant

engineer estimates that the old machines could be used for as many as more years. The

purchase price for the new machines is $ million apiece, which would be depreciated over a

year period on a straightline basis to a net book value of $ each. Each new

machine is expected to produce a pretax operating savings of $ million per year over the

machine it would replace. You estimate that you could sell the old machines for $

each. Installation of each new machine would be expected to cost $ in addition to the

purchase price. Of this amount $ would be capitalized in the same way as the

purchase price, and the remaining $ would be expensed immediately. The increases

in inventory and accounts payable cause a required increase in net working capital of

$ The tax rate is

Answer the below questions.

a What is the initial cash investment for the new equipment?

b The sale of the machine currently in use would have two effects on

future cash flows. The first effect creates a tax saving. Describe this positive

effect.

c The second tax effect on future cash flows causes a net outlay. Describe

this effect.

d Compute the net initial outlay.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started