Answered step by step

Verified Expert Solution

Question

1 Approved Answer

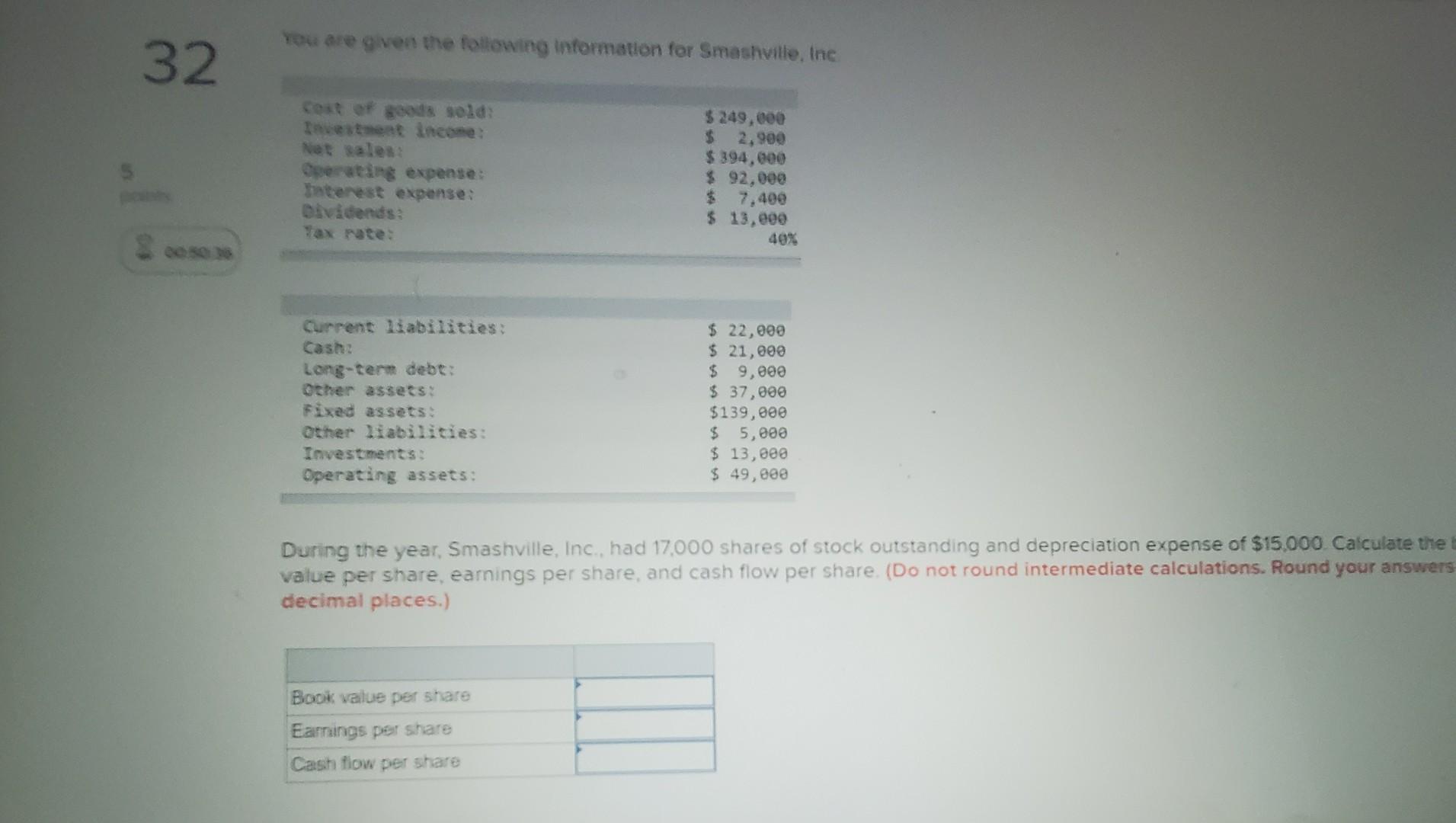

You are given the following information for Smashville, Inc 32. cost of goods sold: Investment income: Net sales: Operating expense: haterest expense: Dividends: Tax rate:

You are given the following information for Smashville, Inc 32. cost of goods sold: Investment income: Net sales: Operating expense: haterest expense: Dividends: Tax rate: $ 249,000 $ 2,900 $ 394,000 $ 92,000 $ 7,400 $ 13,000 40% Current liabilities: Long-term debt: Other assets: Fixed assets: Other liabilities: Investments: Operating assets: $ 22,000 $ 21,000 $ 9,000 $ 37,000 $139,000 $ 5,000 $ 13,000 $ 49,000 During the year, Smashville, Inc., had 17,000 shares of stock outstanding and depreciation expense of $15,000 Calculate the value per share, earnings per share, and cash flow per share. (Do not round intermediate calculations. Round your answers decimal places.) Book value per share Earnings per share Cash flow per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started