Answered step by step

Verified Expert Solution

Question

1 Approved Answer

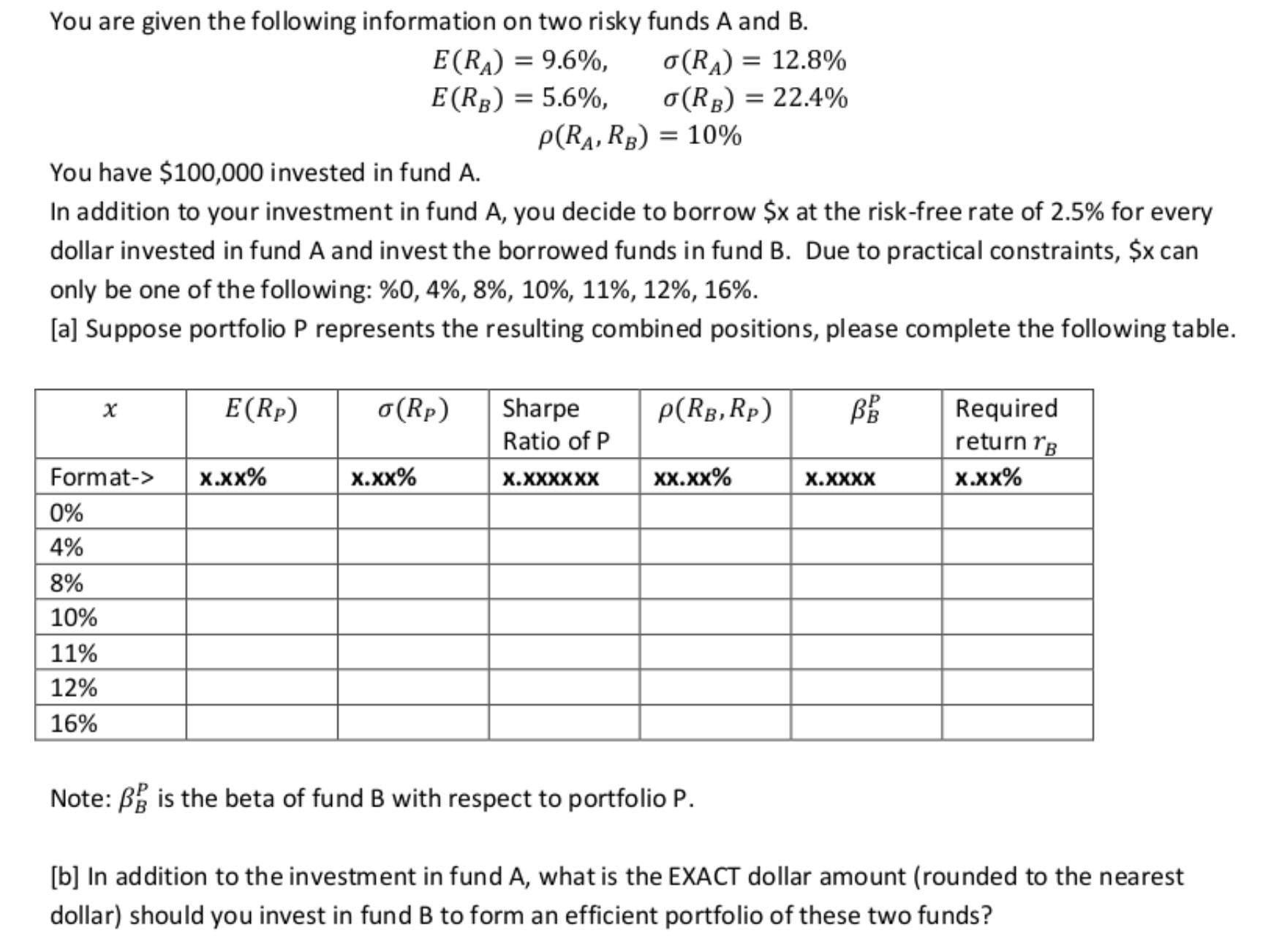

You are given the following information on two risky funds A and B. (RA) = 12.8% E (RA) = 9.6%, E (RB) = 5.6%,

You are given the following information on two risky funds A and B. (RA) = 12.8% E (RA) = 9.6%, E (RB) = 5.6%, (RB) = 22.4% You have $100,000 invested in fund A. In addition to your investment in fund A, you decide to borrow $x at the risk-free rate of 2.5% for every dollar invested in fund A and invest the borrowed funds in fund B. Due to practical constraints, $x can only be one of the following: %0, 4%, 8%, 10 %, 11%, 12%, 16%. [a] Suppose portfolio P represents the resulting combined positions, please complete the following table. X Format-> 0% 4% 8% 10% 11% 12% 16% E (Rp) X.XX% (Rp) P(RA, RB) = 10% X.XX% Sharpe Ratio of P X.XXXXXX P(RB, Rp) XX.XX% Note: B is the beta of fund B with respect to portfolio P. BB X.XXXX Required return B X.XX% [b] In addition to the investment in fund A, what is the EXACT dollar amount (rounded to the nearest dollar) should you invest in fund B to form an efficient portfolio of these two funds?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Using the given information we can calculate the values for the table as follows x ERp Rp Sharpe R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started