Answered step by step

Verified Expert Solution

Question

1 Approved Answer

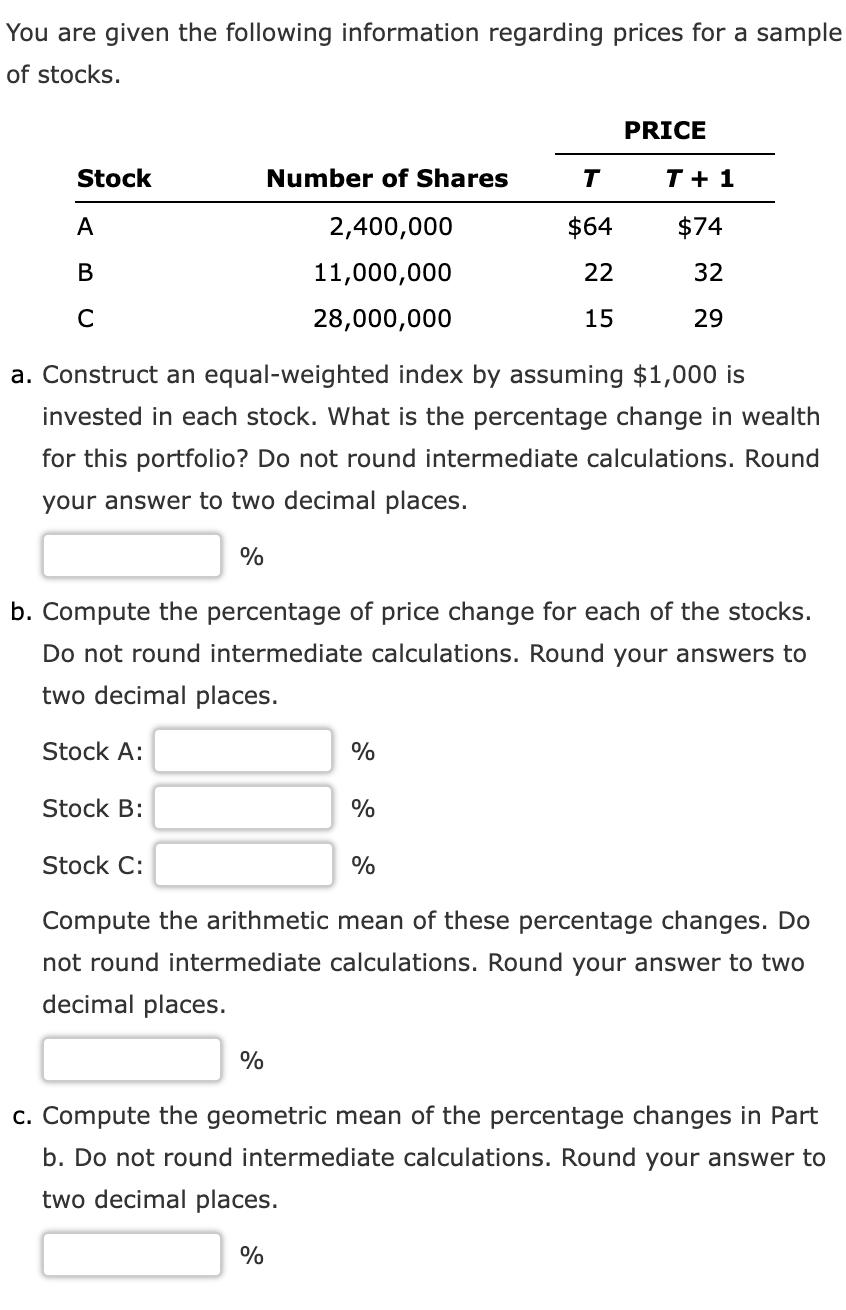

You are given the following information regarding prices for a sample of stocks. Stock A B C Stock B: % Stock C: a. Construct

You are given the following information regarding prices for a sample of stocks. Stock A B C Stock B: % Stock C: a. Construct an equal-weighted index by assuming $1,000 is invested in each stock. What is the percentage change in wealth for this portfolio? Do not round intermediate calculations. Round your answer to two decimal places. Number of Shares 2,400,000 11,000,000 28,000,000 b. Compute the percentage of price change for each of the stocks. Do not round intermediate calculations. Round your answers to two decimal places. Stock A: % % % T $64 22 15 % PRICE % T + 1 $74 32 29 Compute the arithmetic mean of these percentage changes. Do not round intermediate calculations. Round your answer to two decimal places. c. Compute the geometric mean of the percentage changes in Part b. Do not round intermediate calculations. Round your answer to two decimal places.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Construct an equal weighted index as follows Equal Weigh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started