Question

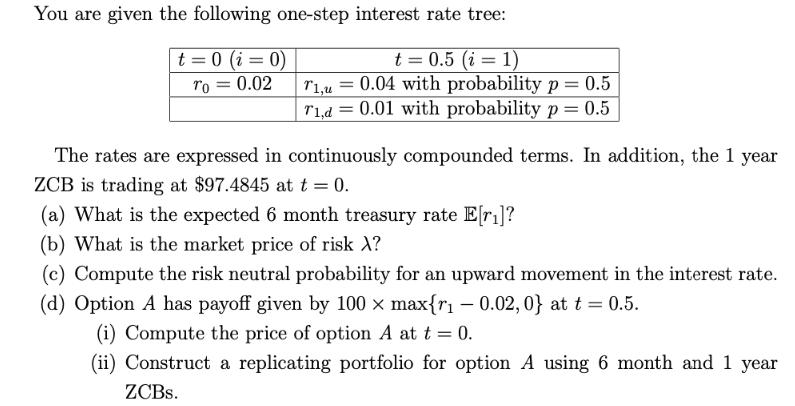

You are given the following one-step interest rate tree: t = 0.5 (i = 1) T1,u = 0.04 with probability p = 0.5| Tid

You are given the following one-step interest rate tree: t = 0.5 (i = 1) T1,u = 0.04 with probability p = 0.5| Tid = 0.01 with probability p = 0.5 T1,d t=0 (i=0) To = 0.02 The rates are expressed in continuously compounded terms. In addition, the 1 year ZCB is trading at $97.4845 at t = 0. (a) What is the expected 6 month treasury rate E[r]? (b) What is the market price of risk X? (c) Compute the risk neutral probability for an upward movement in the interest rate. (d) Option A has payoff given by 100 x max{r -0.02, 0} at t = 0.5. (i) Compute the price of option A at t = 0. (ii) Construct a replicating portfolio for option A using 6 month and 1 year ZCBs.

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a To find the expected 6month treasury rate we need to calculate the expected value using the given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics

Authors: Robert J Gordon

12th edition

138014914, 978-0138014919

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App