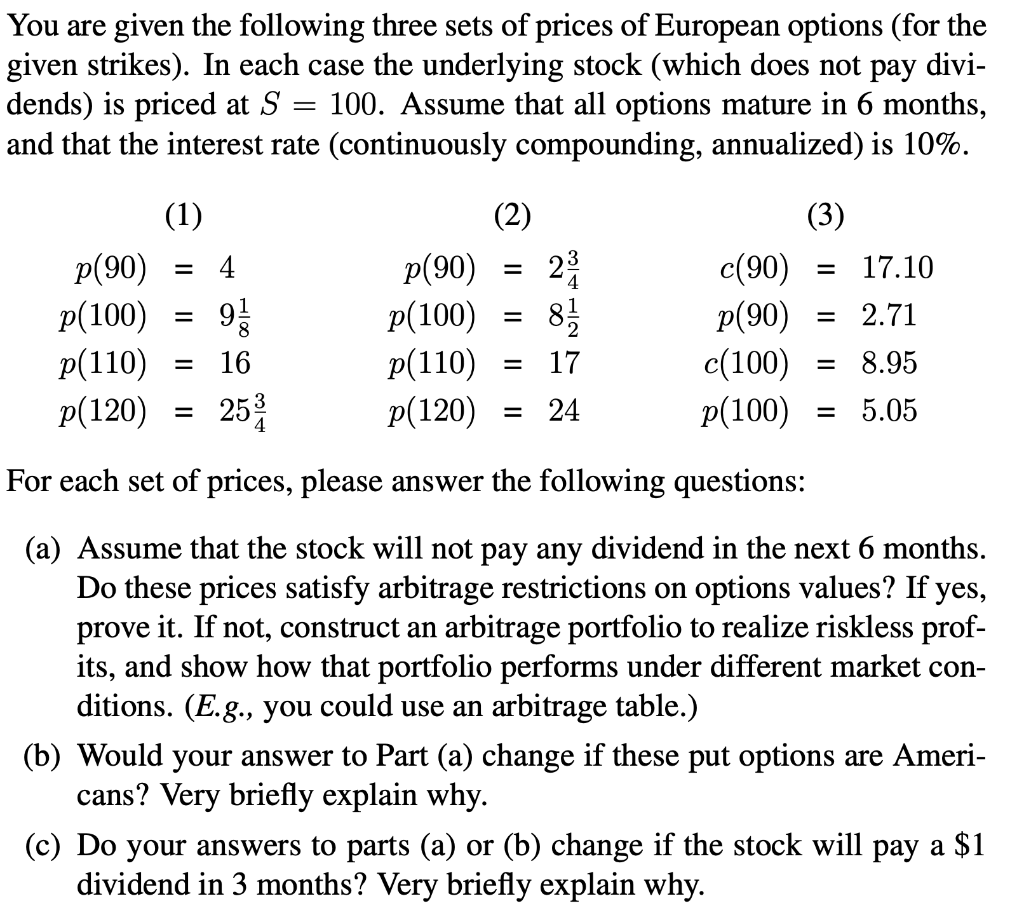

You are given the following three sets of prices of European options (for the given strikes). In each case the underlying stock (which does not pay divi- dends) is priced at S 100. Assume that all options mature in 6 months, and that the interest rate (continuously compounding, annualized) is 10%. = (3) = 17.10 (1) p(90) = 4 p(100) = 9 p(110) = 16 p(120) 253 (2) 23 82 = 17 p(90) p(100) p(110) p(120) = 2.71 c(90) p(90) c(100) p(100) = 8.95 = 24 = 5.05 For each set of prices, please answer the following questions: (a) Assume that the stock will not pay any dividend in the next 6 months. Do these prices satisfy arbitrage restrictions on options values? If yes, prove it. If not, construct an arbitrage portfolio to realize riskless prof- its, and show how that portfolio performs under different market con- ditions. (E.g., you could use an arbitrage table.) (b) Would your answer to Part (a) change if these put options are Ameri- cans? Very briefly explain why. (c) Do your answers to parts (a) or (b) change if the stock will pay a $1 dividend in 3 months? Very briefly explain why. You are given the following three sets of prices of European options (for the given strikes). In each case the underlying stock (which does not pay divi- dends) is priced at S 100. Assume that all options mature in 6 months, and that the interest rate (continuously compounding, annualized) is 10%. = (3) = 17.10 (1) p(90) = 4 p(100) = 9 p(110) = 16 p(120) 253 (2) 23 82 = 17 p(90) p(100) p(110) p(120) = 2.71 c(90) p(90) c(100) p(100) = 8.95 = 24 = 5.05 For each set of prices, please answer the following questions: (a) Assume that the stock will not pay any dividend in the next 6 months. Do these prices satisfy arbitrage restrictions on options values? If yes, prove it. If not, construct an arbitrage portfolio to realize riskless prof- its, and show how that portfolio performs under different market con- ditions. (E.g., you could use an arbitrage table.) (b) Would your answer to Part (a) change if these put options are Ameri- cans? Very briefly explain why. (c) Do your answers to parts (a) or (b) change if the stock will pay a $1 dividend in 3 months? Very briefly explain why