Answered step by step

Verified Expert Solution

Question

1 Approved Answer

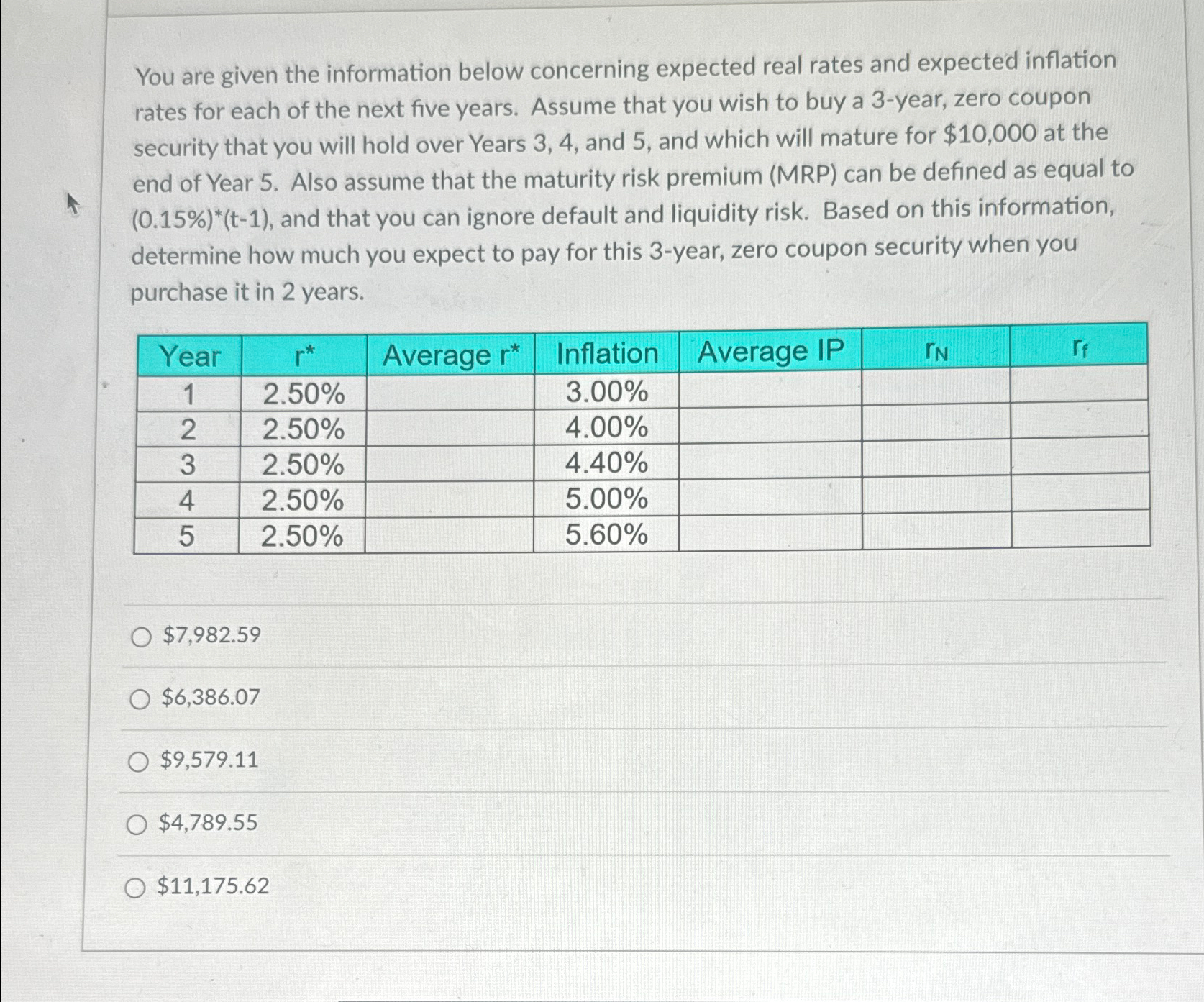

You are given the information below concerning expected real rates and expected inflation rates for each of the next five years. Assume that you wish

You are given the information below concerning expected real rates and expected inflation rates for each of the next five years. Assume that you wish to buy a year, zero coupon security that you will hold over Years and and which will mature for $ at the end of Year Also assume that the maturity risk premium MRP can be defined as equal to and that you can ignore default and liquidity risk. Based on this information, determine how much you expect to pay for this year, zero coupon security when you purchase it in years.

tableYearAverage Inflation,Average IP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started