Answered step by step

Verified Expert Solution

Question

1 Approved Answer

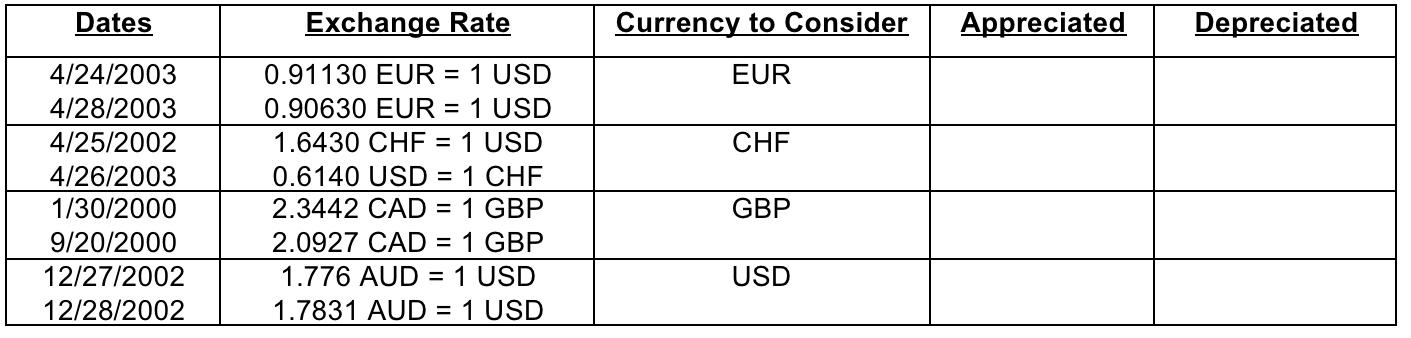

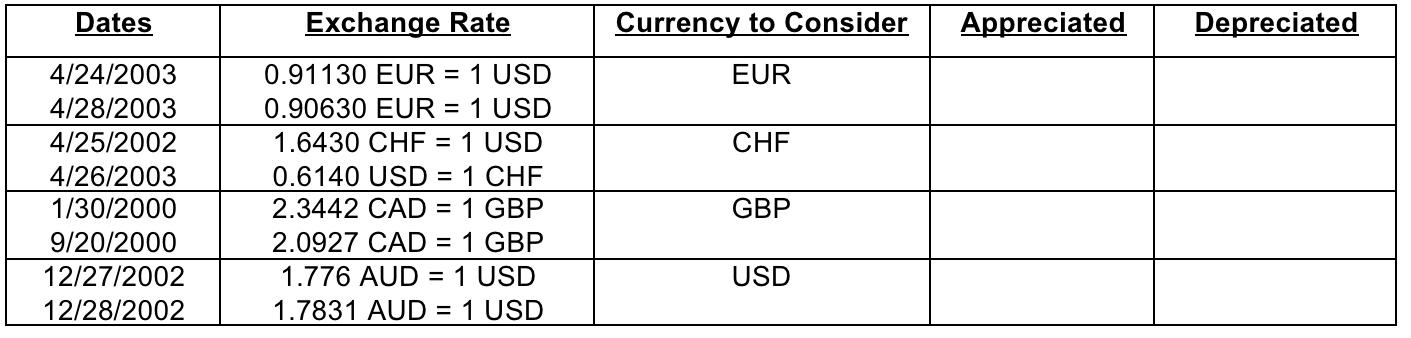

You are given two different exchange rates per pair of currencies. Determine whether the currency in question has appreciated or depreciated. Mark the correct column.

You are given two different exchange rates per pair of currencies. Determine whether the currency in question has appreciated or depreciated. Mark the correct column. Hint: You are given a mixture of direct and indirect quotes so I would re-write the rates so that the currency under consideration is on the denominator;

You are planning a trip to Europe and Japan and want to change AUD into euros and yen. Your bank provides the following quotes: Euros ($1.194 - $1.245) and Yen ($.009245 - $.00967).

How much would you lose if you converted $100 into euros and then back into dollars and $100 into yen and then back into dollars.

You are planning a trip to Europe and Japan and want to change AUD into euros and yen. Your bank provides the following quotes: Euros ($1.194 - $1.245) and Yen ($.009245 - $.00967).

How much would you lose if you converted $100 into euros and then back into dollars and $100 into yen and then back into dollars.

Dates 4/24/2003 4/28/2003 4/25/2002 4/26/2003 1/30/2000 9/20/2000 12/27/2002 12/28/2002 Exchange Rate 0.91130 EUR = 1 USD 0.90630 EUR = 1 USD 1.6430 CHF = 1 USD 0.6140 USD = 1 CHF 2.3442 CAD = 1 GBP 2.0927 CAD = 1 GBP 1.776 AUD = 1 USD 1.7831 AUD = 1 USD Currency to Consider EUR CHF GBP USD Appreciated Depreciated

Step by Step Solution

★★★★★

3.61 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether a currency has appreciated or depreciated we need to compare the exchange rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started