Question

You are going to have to make a depreciation schedule to be used for tax purposes for the following description: A company purchased a

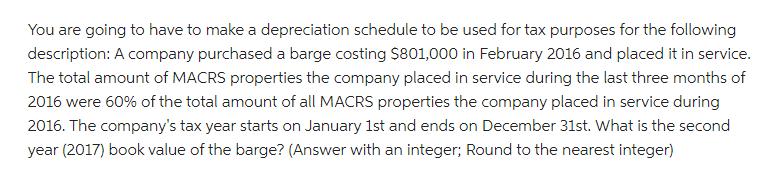

You are going to have to make a depreciation schedule to be used for tax purposes for the following description: A company purchased a barge costing $801,000 in February 2016 and placed it in service. The total amount of MACRS properties the company placed in service during the last three months of 2016 were 60% of the total amount of all MACRS properties the company placed in service during 2016. The company's tax year starts on January 1st and ends on December 31st. What is the second year (2017) book value of the barge? (Answer with an integer; Round to the nearest integer)

Step by Step Solution

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Charles E. Davis, Elizabeth Davis

2nd edition

1118548639, 9781118800713, 1118338448, 9781118548639, 1118800710, 978-1118338445

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App