Question

You are going to put money away every year into a mutual fund which gets 10% a year. You will deposit $6,000 in the first

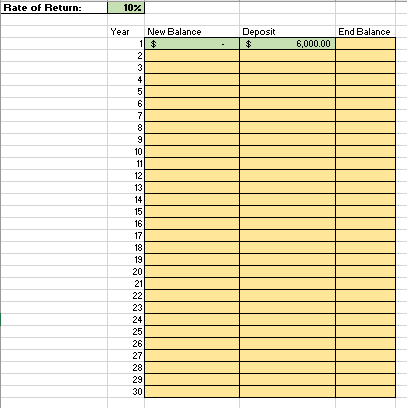

You are going to put money away every year into a mutual fund which gets 10% a year. You will deposit $6,000 in the first year and then increase your deposit by 3% every year (since your salary will be increasing also). Assume you make the deposit at the beginning of the year so it always grows by 10% each year.

a.) Create a spreadsheet which keeps track of this investment over 30 years

b.) How long will it take you to get to $1 million? Give the year in which the ending balance goes above $1 million for the first time.

c.) Given your answer in part b determine what the value of that $1 million is in todays dollars by assuming a 3% inflation rate. In other words, what amount of money today would grow at 3% for the number of years in part b to equal 1 million?

d.) What has a bigger impact on your ending balance after 30 years: increasing the rate of return by 50% to 15% or doubling the initial deposit to $12,000? To answer this change the rate to 15% and look at the end result. Then change back to 10% and change the initial $6,000 to $12,000 and look at the end result. Then reset back to $6,000. Answer should be 15% or $12,000.

Rate of Return 10% Year New Balance Deposit End Balance 6,000.00 10 13 14 15 16 18 19 23 24 26 27 28 29Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started