Answered step by step

Verified Expert Solution

Question

1 Approved Answer

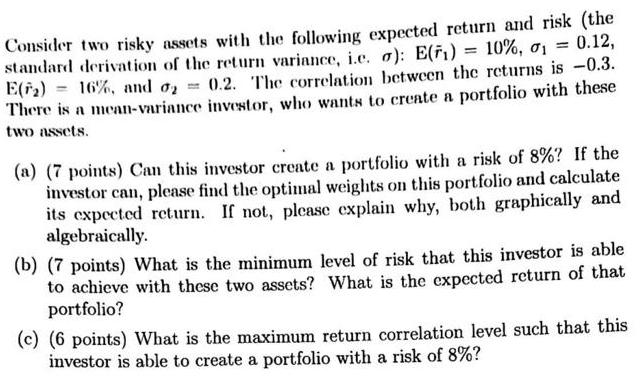

0.12, Consider two risky assets with the following expected return and risk (the standard derivation of the return variance, i.e. a): E(F) = 10%,

0.12, Consider two risky assets with the following expected return and risk (the standard derivation of the return variance, i.e. a): E(F) = 10%, 01 = E() 16%, and 0.2. The correlation between the returns is -0.3. There is a mean-variance investor, who wants to create a portfolio with these two assets. (a) (7 points) Can this investor create a portfolio with a risk of 8%? If the investor can, please find the optimal weights on this portfolio and calculate its expected return. If not, please explain why, both graphically and algebraically. (b) (7 points) What is the minimum level of risk that this investor is able to achieve with these two assets? What is the expected return of that portfolio? (c) (6 points) What is the maximum return correlation level such that this investor is able to create a portfolio with a risk of 8%?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

This investor cannot create a portfolio with a risk of 8 Let w1 be the weight on asset 1 and w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started