Answered step by step

Verified Expert Solution

Question

1 Approved Answer

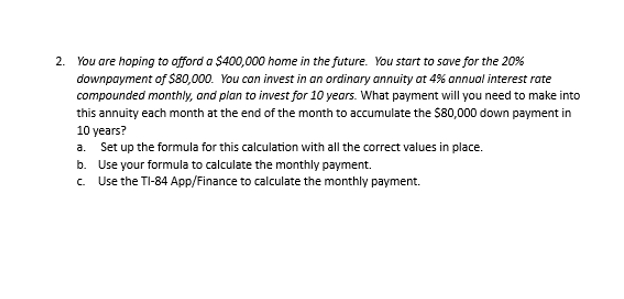

You are hoping to afford a $ 4 0 0 , 0 0 0 home in the future. You start to save for the 2

You are hoping to afford a $ home in the future. You start to save for the

downpayment of $ You can invest in an ordinary annuity ot annual interest rate

compounded monthly, and plan to invest for years. What payment will you need to make into

this annuity each month at the end of the month to accumulate the $ down payment in

years?

a Set up the formula for this calculation with all the correct values in place.

b Use your formula to calculate the monthly payment.

c Use the TI Finance to calculate the monthly payment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started