Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are in the midst of valuing a large, risky investment in an offshore windfarm. You are faced with two options: using generic turbines

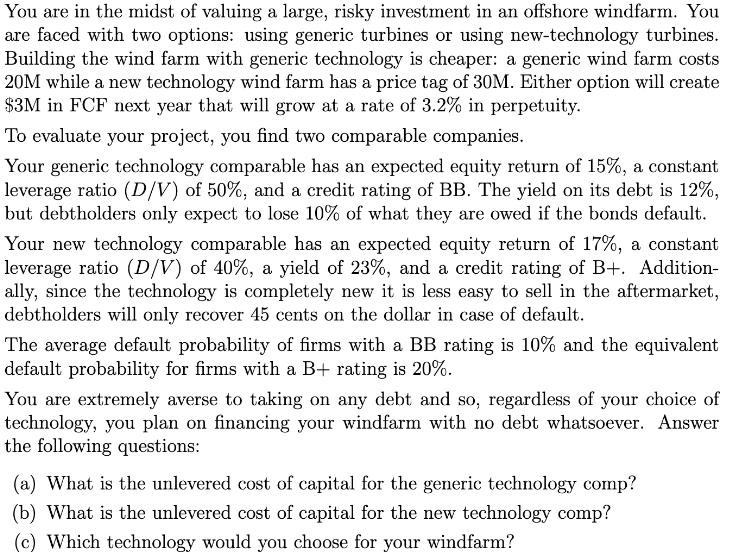

You are in the midst of valuing a large, risky investment in an offshore windfarm. You are faced with two options: using generic turbines or using new-technology turbines. Building the wind farm with generic technology is cheaper: a generic wind farm costs 20M while a new technology wind farm has a price tag of 30M. Either option will create $3M in FCF next year that will grow at a rate of 3.2% in perpetuity. To evaluate your project, you find two comparable companies. Your generic technology comparable has an expected equity return of 15%, a constant leverage ratio (D/V) of 50%, and a credit rating of BB. The yield on its debt is 12%, but debtholders only expect to lose 10% of what they are owed if the bonds default. Your new technology comparable has an expected equity return of 17%, a constant leverage ratio (D/V) of 40%, a yield of 23%, and a credit rating of B+. Addition- ally, since the technology is completely new it is less easy to sell in the aftermarket, debtholders will only recover 45 cents on the dollar in case of default. The average default probability of firms with a BB rating is 10% and the equivalent default probability for firms with a B+ rating is 20%. You are extremely averse to taking on any debt and so, regardless of your choice of technology, you plan on financing your windfarm with no debt whatsoever. Answer the following questions: (a) What is the unlevered cost of capital for the generic technology comp? (b) What is the unlevered cost of capital for the new technology comp? (c) Which technology would you choose for your windfarm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The unlevered cost of capital for the generic technology comp can be calculated as Unlevered cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started