Question

You are in the USA, and you buy a UK stock at 75.50. When you buy the stock, the spot exchange rate for the

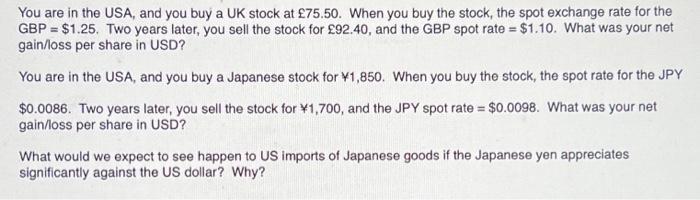

You are in the USA, and you buy a UK stock at 75.50. When you buy the stock, the spot exchange rate for the GBP = $1.25. Two years later, you sell the stock for 92.40, and the GBP spot rate = $1.10. What was your net gain/loss per share in USD? You are in the USA, and you buy a Japanese stock for 1,850. When you buy the stock, the spot rate for the JPY $0.0086. Two years later, you sell the stock for 1,700, and the JPY spot rate = $0.0098. What was your net gain/loss per share in USD? What would we expect to see happen to US imports of Japanese goods if the Japanese yen appreciates significantly against the US dollar? Why?

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

It seems like there are multiple questions related to foreign exchange rates and stock transactions ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Principles And Practice

Authors: Denzil Watson, Antony Head

9th Edition

1292450940, 978-1292450940

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App