Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are interested in buying a piece of real property that could be worth $300,000 in 10 years. Assuming that your money is worth

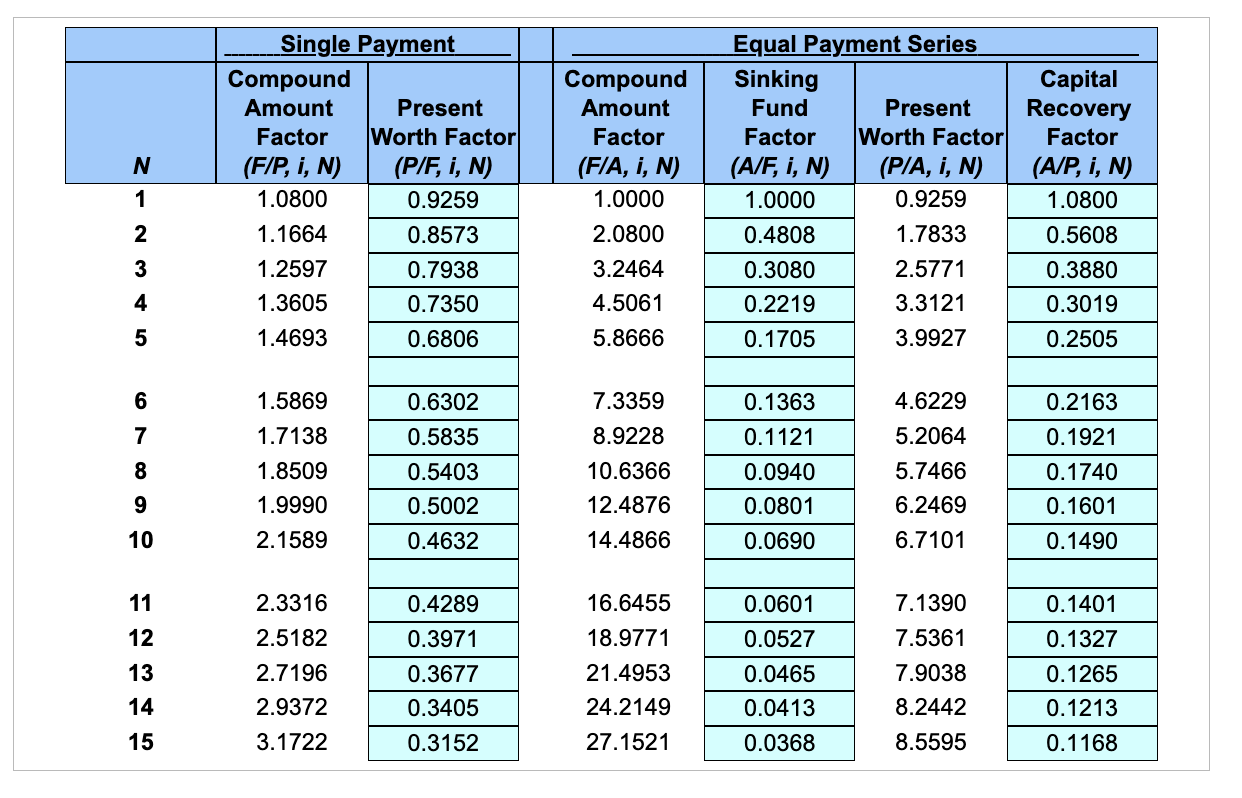

You are interested in buying a piece of real property that could be worth $300,000 in 10 years. Assuming that your money is worth 8%, how much would you be willing to pay for the property? Click the icon to view the interest factors for discrete compounding when i = 8% per year. The maximum amount you would be willing to pay for the property is $ thousand. (Round to the nearest whole number.) N SAWN 2 1 2 3 4 5 6 6 7 8 9 10 11 12 13 14 15 Single Payment Compound Amount Factor (F/P, i, N) 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 2.3316 2.5182 2.7196 2.9372 3.1722 Present Worth Factor (P/F, i, N) 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 Compound Amount Factor (F/A, i, N) 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 16.6455 18.9771 21.4953 24.2149 27.1521 Equal Payment Series Sinking Fund Factor (A/F, i, N) 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 0.0601 0.0527 0.0465 0.0413 0.0368 Present Worth Factor (P/A, i, N) 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 7.1390 7.5361 7.9038 8.2442 8.5595 Capital Recovery Factor (A/P, i, N) 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 0.1401 0.1327 0.1265 0.1213 0.1168

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Future value of the property at 10th year 300000 Interest Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started