Answered step by step

Verified Expert Solution

Question

1 Approved Answer

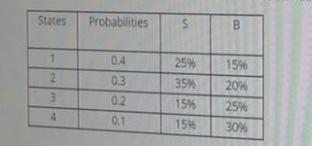

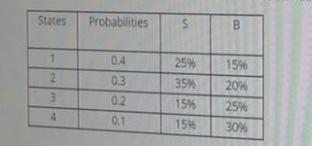

you are interested in making investment in S and B. The risk-free rate of return is 6% and the market risk premium is 7%. The

you are interested in making investment in S and B. The risk-free rate of return is 6% and the market risk premium is 7%. The expected return of S is 25%, the expected return of B is 20%. The standard deviation of S is 9.22% and the standard deviation of B is 5%

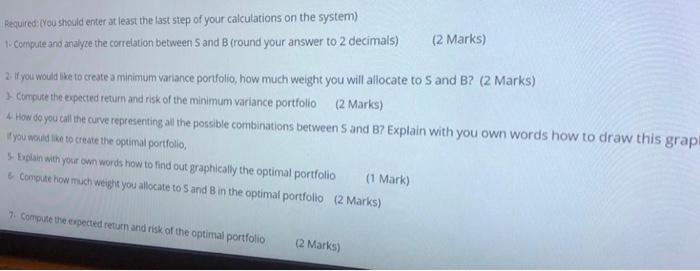

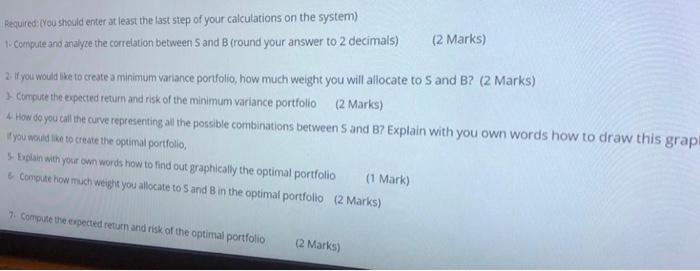

States Probabilities s B 0.4 25% 1596 2 0.3 359 20% 3 02 15% 25% 4 0.1 15 30% Required (You should enter at least the last step of your calculations on the system) 1. Compute and analyze the correlation between Sand B (round your answer to 2 decimals) (2 Marks) 2. If you would like to create a minimum variance portfolio, how much weight you will allocate to S and B? (2 Marks) > Compute the expected return and risk of the minimum variance portfolio (2 Marks) 4. How do you call the curve representing all the possible combinations between 5 and B? Explain with you own words how to draw this grap you would like to create the optimal portfolio, Explain with your own words how to find out graphically the optimal portfolio (1 Mark) Compute how much weight you allocate to S and B in the optimal portfolio (2 Marks) 7. Compute the expected return and risk of the optimal portfolio (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started