Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are Joan Jacks an Accountant for Riscko, a company that specialises in risk management. You regularly assess whether your debtors will become bad

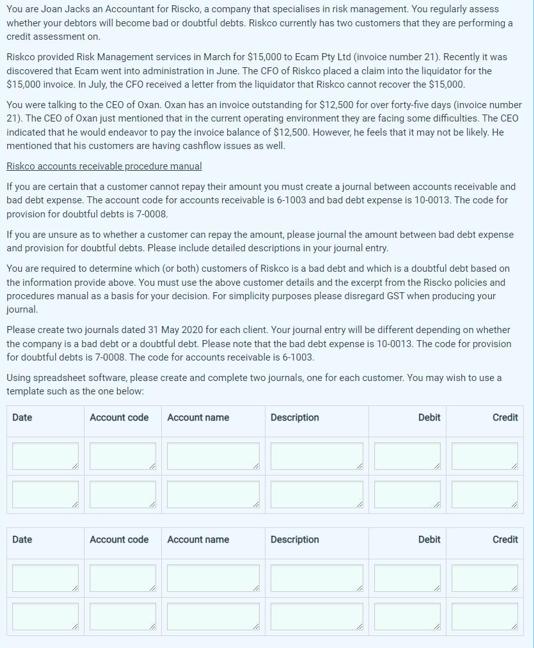

You are Joan Jacks an Accountant for Riscko, a company that specialises in risk management. You regularly assess whether your debtors will become bad or doubtful debts. Riskco currently has two customers that they are performing a credit assessment on. Riskco provided Risk Management services in March for $15,000 to Ecam Pty Ltd (invoice number 21). Recently it was discovered that Ecam went into administration in June. The CFO of Riskco placed a claim into the liquidator for the $15,000 invoice. In July, the CFO received a letter from the liquidator that Riskco cannot recover the $15,000. You were talking to the CEO of Oxan. Oxan has an invoice outstanding for $12,500 for over forty-five days (invoice number 21). The CEO of Oxan just mentioned that in the current operating environment they are facing some difficulties. The CEO indicated that he would endeavor to pay the invoice balance of $12,500. However, he feels that it may not be likely. He mentioned that his customers are having cashflow issues as well. Riskco accounts receivable procedure manual If you are certain that a customer cannot repay their amount you must create a journal between accounts receivable and bad debt expense. The account code for accounts receivable is 6-1003 and bad debt expense is 10-0013. The code for provision for doubtful debts is 7-0008, If you are unsure as to whether a customer can repay the amount, please journal the amount between bad debt expense and provision for doubtful debts. Please include detailed descriptions in your journal entry. You are required to determine which (or both) customers of Riskco is a bad debt and which is a doubtful debt based on the information provide above. You must use the above customer details and the excerpt from the Riscko policies and procedures manual as a basis for your decision. For simplicity purposes please disregard GST when producing your journal. Please create two journals dated 31 May 2020 for each client. Your journal entry will be different depending on whether the company is a bad debt or a doubtful debt. Please note that the bad debt expense is 10-0013. The code for provision for doubtful debts is 7-0008. The code for accounts receivable is 6-1003 Using spreadsheet software, please create and complete two journals, one for each customer. You may wish to use a template such as the one below: Date Account code Account name Date Account code Account name Description Description Debit Debit Credit Credit

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry for Ecam Pty Ltd Bad Debt Date 31 May 2020 Account code 61003 Account name Accounts Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started