Answered step by step

Verified Expert Solution

Question

1 Approved Answer

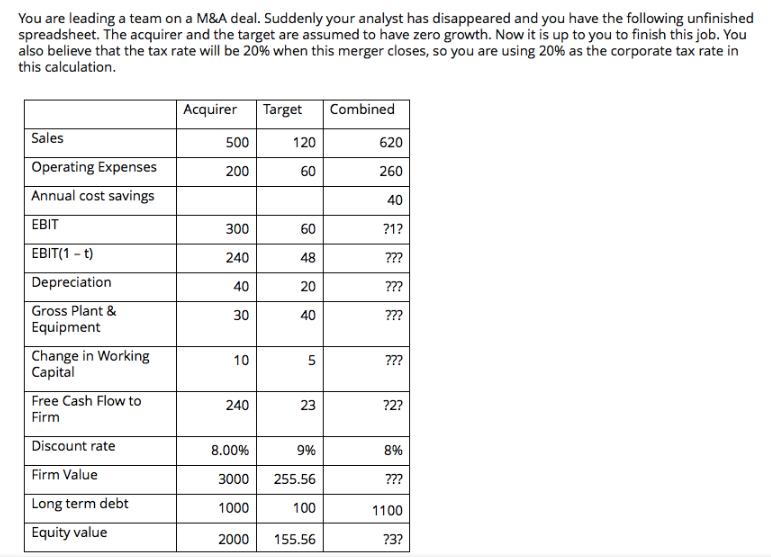

You are leading a team on a M&A deal. Suddenly your analyst has disappeared and you have the following unfinished spreadsheet. The acquirer and

You are leading a team on a M&A deal. Suddenly your analyst has disappeared and you have the following unfinished spreadsheet. The acquirer and the target are assumed to have zero growth. Now it is up to you to finish this job. You also believe that the tax rate will be 20% when this merger closes, so you are using 20% as the corporate tax rate in this calculation. Sales Operating Expenses Annual cost savings EBIT EBIT(1-t) Depreciation Gross Plant & Equipment Change in Working Capital Free Cash Flow to Firm Discount rate Firm Value Long term debt Equity value Acquirer 500 200 300 240 40 30 10 240 Target 120 60 60 48 20 40 5 23 8.00% 9% 3000 255.56 1000 100 2000 155.56 Combined 620 260 40 ?1? ??? | | ??? ??? ??? ?2? 8% ??? 1100 ?3? ?1? is ?2? is ?3? is The synergy of this merger is The maximum offer you can make is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To fill in the missing information in the spreadsheet and answer the final questions lets go through the calculations step by step Were given the fina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started