Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are looking at a one-year loan of $18,000. The Interest rate is quoted as 9 percent plus three points. A point on a

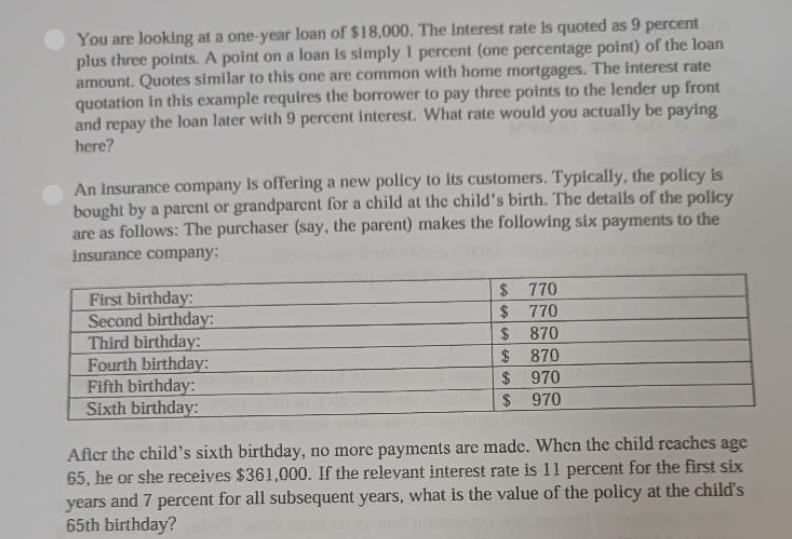

You are looking at a one-year loan of $18,000. The Interest rate is quoted as 9 percent plus three points. A point on a loan is simply 1 percent (one percentage point) of the loan amount. Quotes similar to this one are common with home mortgages. The interest rate up front quotation in this example requires the borrower to pay three points to the lender and repay the loan later with 9 percent interest. What rate would you actually be paying here? An insurance company is offering a new policy to its customers. Typically, the policy is bought by a parent or grandparent for a child at the child's birth. The details of the policy are as follows: The purchaser (say, the parent) makes the following six payments to the insurance company: First birthday: Second birthday: Third birthday: Fourth birthday: Fifth birthday: Sixth birthday: $ $ $ $ $ $ 770 770 870 870 970 970 After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $361,000. If the relevant interest rate is 11 percent for the first six years and 7 percent for all subsequent years, what is the value of the policy at the child's 65th birthday?

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the actual interest rate you would be paying on the oneyear loan with an interest rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started