You are looking to help a small municipality finance their drinking water treatment facility with the installation of UV (ultraviolet) disinfection. The total cost

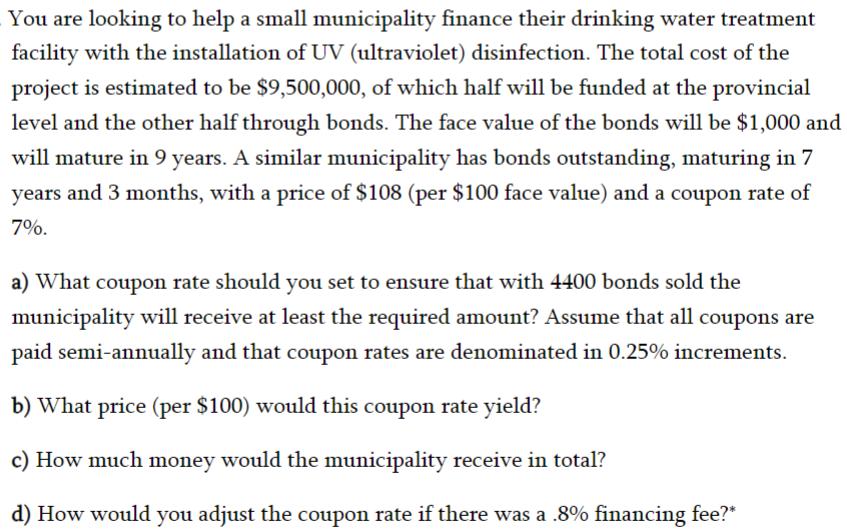

You are looking to help a small municipality finance their drinking water treatment facility with the installation of UV (ultraviolet) disinfection. The total cost of the project is estimated to be $9,500,000, of which half will be funded at the provincial level and the other half through bonds. The face value of the bonds will be $1,000 and will mature in 9 years. A similar municipality has bonds outstanding, maturing in 7 years and 3 months, with a price of $108 (per $100 face value) and a coupon rate of 7%. a) What coupon rate should you set to ensure that with 4400 bonds sold the municipality will receive at least the required amount? Assume that all coupons are paid semi-annually and that coupon rates are denominated in 0.25% increments. b) What price (per $100) would this coupon rate yield? c) How much money would the municipality receive in total? d) How would you adjust the coupon rate if there was a .8% financing fee?* e) What price would you expect (based on $100 face value) in this case and what would be the total money received by the municipality?

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the coupon rate price total amount received and adjusted coupon rate with a financing fee we can follow these steps a Calculate the total ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started