Answered step by step

Verified Expert Solution

Question

1 Approved Answer

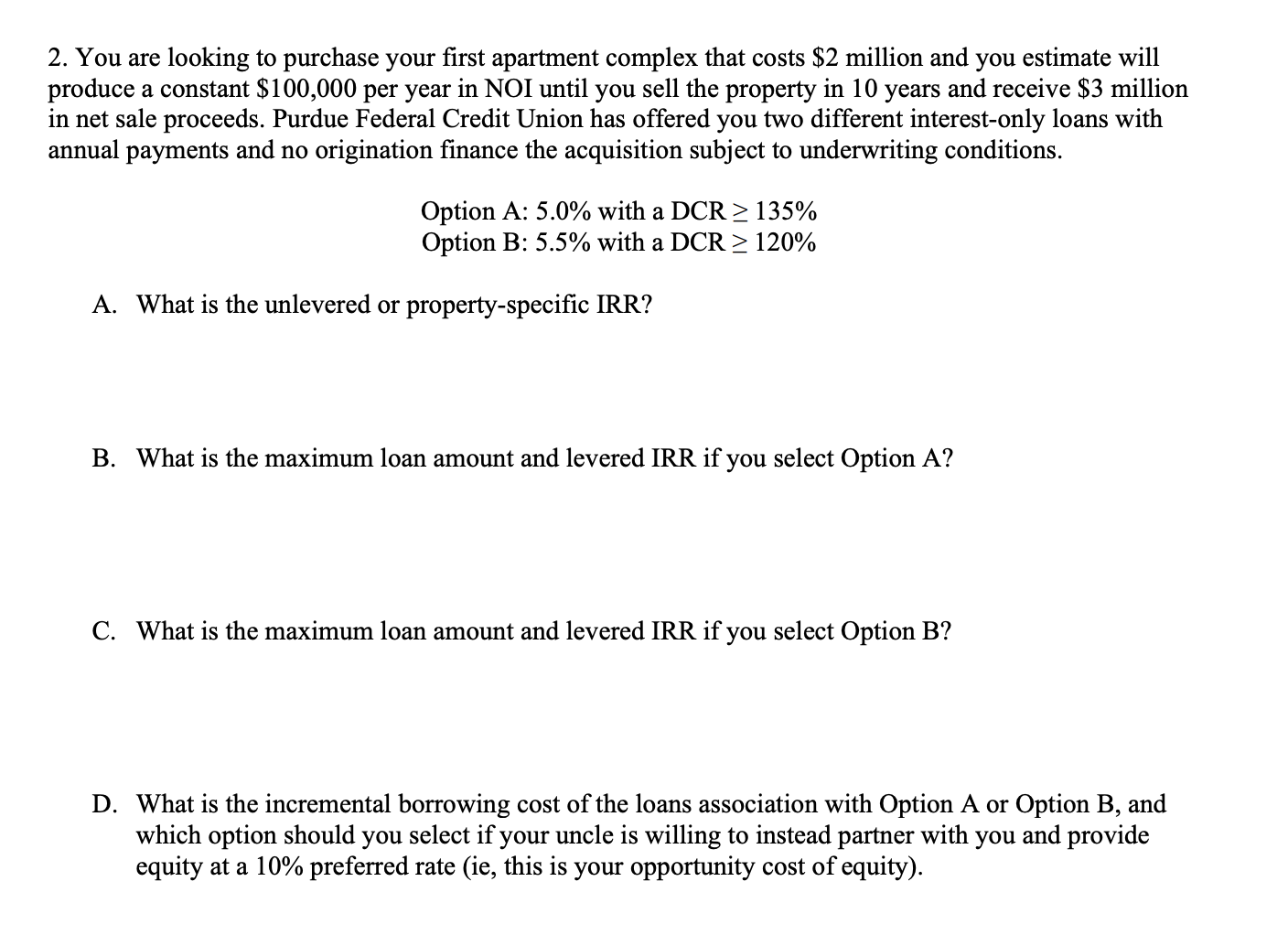

You are looking to purchase your first apartment complex that costs $ 2 million and you estimate will produce a constant $ 1 0 0

You are looking to purchase your first apartment complex that costs $ million and you estimate will

produce a constant $ per year in NOI until you sell the property in years and receive $ million

in net sale proceeds. Purdue Federal Credit Union has offered you two different interestonly loans with

annual payments and no origination finance the acquisition subject to underwriting conditions.

Option A: with a DCR

Option B: with a DCR

A What is the unlevered or propertyspecific IRR?

B What is the maximum loan amount and levered IRR if you select Option A

C What is the maximum loan amount and levered IRR if you select Option B

D What is the incremental borrowing cost of the loans association with Option A or Option B and

which option should you select if your uncle is willing to instead partner with you and provide

equity at a preferred rate ie this is your opportunity cost of equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started