Question

You are making and designing investment portfolios for two unrelated investors.Each has $2,000,000 to invest and you can offer them shares in one or more

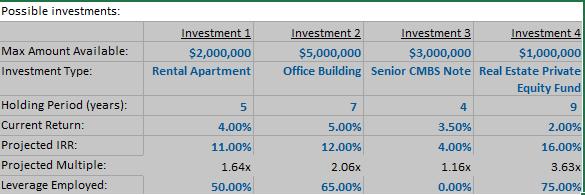

You are making and designing investment portfolios for two unrelated investors. Each has $2,000,000 to invest and you can offer them shares in one or more of the four real estate investments shown in the table below. For each investor you may choose any amount to invest in any or all of the four investments, but your combined investment for all investors cannot exceed the indicated amounts available.

The first investor is a retired school teacher. The teacher has a fully funded pension, and all the proceeds will be used to fund the teacher's grandchild's college education, which starts more than 10 years from now. The second investor is a recently divorced single parent who is looking for current income to supplement spousal support payments until the children are old enough and the investor can return to the work force on a full-time basis. You demand diversification, so no more than 50% of on any of your clients' portfolios will be invested in a single asset.

Based on the information given, what is the expected current yield if each investor was evenly invested in each of the four potential investments?

Based on the information given, which investment is LEAST suitable for the retired school teacher? Why?

Based on the information given, which investment is LEAST suitable for the single parent? Why?

Recommend a portfolio for the retired school teacher and calculate the investment multiple for that portfolio.

Recommend a portfolio for the single parent and calculate the current yield (first year) for that portfolio.

As an investment manager, do you believe this scenario will generate any conflicts in allocating assets to the two investors?

Possible investments: Max Amount Available: Investment Type: Holding Period (years): Current Return: Projected IRR: Projected Multiple: Leverage Employed: Investment 1 $2,000,000 Rental Apartment 5 4.00% 11.00% 1.64x 50.00% Investment 2 Investment 3 Investment 4 $5,000,000 $3,000,000 $1,000,000 Office Building Senior CMBS Note Real Estate Private Equity Fund 9 2.00% 16.00% 3.63x 75.00% 7 5.00% 12.00% 2.06x 65.00% 4 3.50% 4.00% 1.16x 0.00%

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 The expected current yield if each investor was evenly invested in each investment is 35 4 5 24 36...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started