Question

You are managing a small software firm producing games for mobile devices and are considering introducing a new adventure game to customers. You plan to

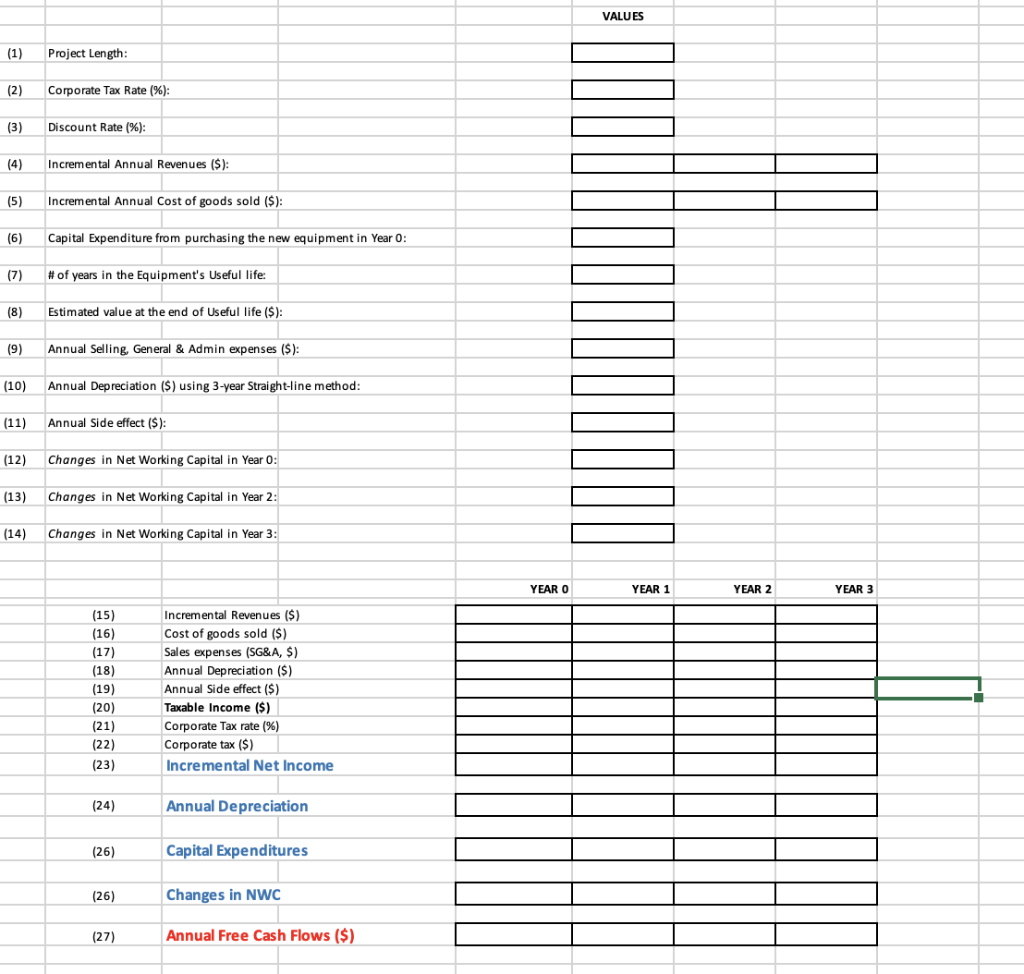

You are managing a small software firm producing games for mobile devices and are considering introducing a new adventure game to customers. You plan to sell the game for the next 3 years and then exit before the competition catches up. Based on the market research done last year for $30,000, you believe that, in year 1, the project will generate $4,800,000 of revenues with the cost of goods sold of $2,850,000. The revenues and the costs will diminish by 2% each year after that. The project will immediately require new computer equipment valued at $1,800,000. This equipment will be depreciated to $0 over 3 years using the straight-line method. The net working capital will increase immediately by $400,000 from the current level, stay at the new level in year 1 and then decrease by $250,000 in year 2, and again decrease by $150,000 in year 3, returning to the current level. The introduction of the new game will affect the revenues from your other existing adventure games negatively by $190,000 per year. You will have to hire additional sales professionals to market the new product during the project, and their combined annual salary will be $250,000. Forecast all of the annual free cash flows for this project, and then compute its net present value and IRR using a discount rate of 9%. Is this project worth taking? Your companys tax rate is 35%.

Use excel template:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started