Question

You are managing an investment portfolio X on behalf of your clients. Assume the assets within portfolio X belong to three asset classes: stocks, fixed

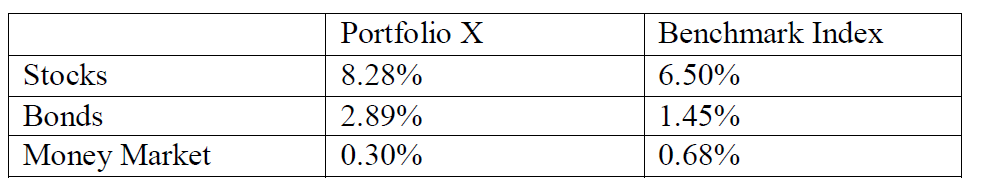

You are managing an investment portfolio X on behalf of your clients. Assume the assets within portfolio X belong to three asset classes: stocks, fixed income and cash, with weights 60%, 9% and 31%. Suppose the benchmark index weights had been set at 65% equity, 18% bonds and 17% money market. The return of the benchmark index and the managed portfolio X for each asset class for last year were as follows:  a.Calculate the excess return of portfolio X.[3 marks] b.Lets focus on the bond asset classes among the portfolio X. You have a one-year,$100,000 bond carries a coupon rate of 10%. The bond will make the payment of accruedinterest and one-half of the principal at the end of six months. The remaining principal andaccrued interest are due at the end of the year. If the required yield is 20% annually, what is the duration of the bond? [Please keep three decimals]. [5 marks

a.Calculate the excess return of portfolio X.[3 marks] b.Lets focus on the bond asset classes among the portfolio X. You have a one-year,$100,000 bond carries a coupon rate of 10%. The bond will make the payment of accruedinterest and one-half of the principal at the end of six months. The remaining principal andaccrued interest are due at the end of the year. If the required yield is 20% annually, what is the duration of the bond? [Please keep three decimals]. [5 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started