Question

You are moving from New Brunswick to British Columbia. Your regular $65,000 salary will be subject to BC taxes. As is the case in Canada

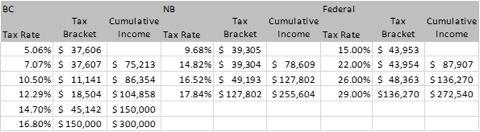

You are moving from New Brunswick to British Columbia. Your regular $65,000 salary will be subject to BC taxes. As is the case in Canada and the provinces the first $15,000 of your income will not be subject to any taxes. Also, you expect to receive $3,000 in dividends and make $2,000 in profit (capital gain) in a stock sale. The tax tables are included below. Dividends are subject to a 38% gross up and the combined dividend tax credits for NB are 10% and 15% in BC. As well, capital gains are taxed at 50% of income.

1) What total income taxes would you pay in both provinces?

2) By how much (in dollars) will your net tax bill change from moving to BC from NB?

BC NB Federal Cumulative Cumulative Tax Cumulative Tax Rate Bracket Income Tax Rate Bracket Income Tax Rate Bracket Income 5.06% $ 37,606 9.68% $ 39,305 15.00% $ 43,953 7.07% S 37,607 S 75,213 14.82% S 39,304 $ 78,609 22.00% $ 43,954 S 87,907 26.00% $ 48,363 $136,27O 29.00% $136,270 $ 272,540 10.50% $ 11,141 $ 86,354 16.52% S 49,193 $127,802 12.29% $ 18,504 $104,858 17.84% $127,802 $255,604 14.70% S 45,142 S150,000 16.80% $150,000 $300,000

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Income taxes paid in both provinces British Columbia We need to determine the adjusted gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started