Question

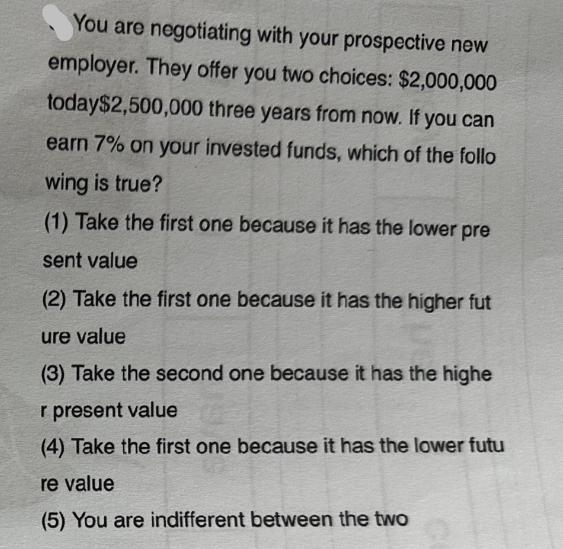

You are negotiating with your prospective new employer. They offer you two choices: $2,000,000 today$2,500,000 three years from now. If you can earn 7%

You are negotiating with your prospective new employer. They offer you two choices: $2,000,000 today$2,500,000 three years from now. If you can earn 7% on your invested funds, which of the follo wing is true? (1) Take the first one because it has the lower pre sent value (2) Take the first one because it has the higher fut ure value (3) Take the second one because it has the highe r present value (4) Take the first one because it has the lower futu re value (5) You are indifferent between the two

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer Take the second one because it has the higher ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Industrial Relations in Canada

Authors: Fiona McQuarrie

4th Edition

978-1-118-8783, 1118878396, 9781119050599 , 978-1118878392

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App