Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are newly employed as the global Transfer pricing manager of a large U.S. multinational corporation with the global Head Office in New York

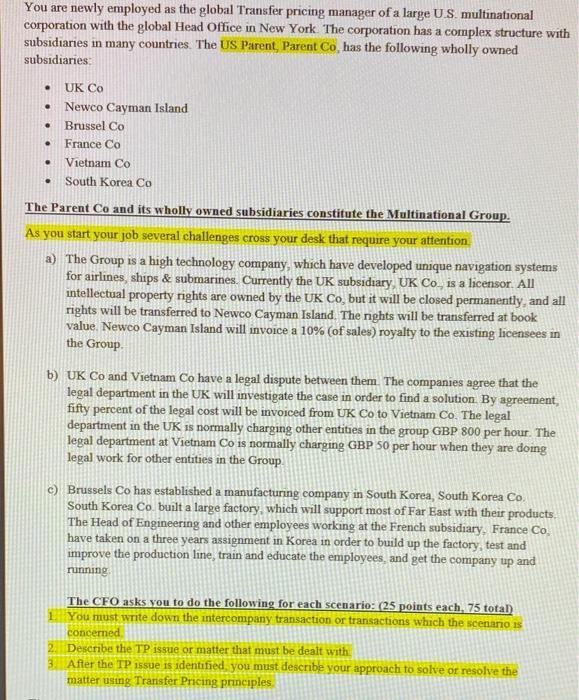

You are newly employed as the global Transfer pricing manager of a large U.S. multinational corporation with the global Head Office in New York The corporation has a complex structure with subsidiaries in many countries. The US Parent, Parent Co, has the following wholly owned subsidiaries: UK Co Newco Cayman Island Brussel Co France Co Vietnam Co South Korea Co The Parent Co and its wholly owned subsidiaries constitute the Multinational Group. As you start your job several challenges cross your desk that require your attention a) The Group is a high technology company, which have developed unique navigation systems for airlnes, ships & submarines. Currently the UK subsidiary, UK Co, is a licensor. All intellectual property rights are owned by the UK Co, but it will be closed permanently, and all rights will be transferred to Newco Cayman Island. The nghts will be transferred at book value. Newco Cayman Island will invoice a 10% (of sales) royalty to the existing licensees in the Group. b) UK Co and Vietnam Co have a legal dispute between them. The companies agree that the legal department in the UK will investigate the case in order to find a solution. By agreement, fifty percent of the legal cost will be invoIced from UK Co to Vietnam Co. The legal department in the UK 1s normally charging other entities in the group GBP 800 per hour. The legal department at Vietnam Co is normally charging GBP 50 per hour when they are doing legal work for other entities in the Group. c) Brussels Co has established a manufacturing company in South Korea, South Korea Co. South Korea Co. built a large factory, which will support most of Far East with their products. The Head of Engineering and other employees working at the French subsidiary. France Co have taken on a three years assignment in Korea in order to build up the factory, test and improve the production line, train and educate the employees, and get the company up and running The CFO asks you to do the following for each scenario: (25 points each, 75 total) 1 You must write down the intercompany transaction or transactions which the scenario is concerned 2. Describe the TP issue or matter that must be dealt with 3 After the TP 1ssue is identified, you must describe your approach to solve or resolve the matter using Transfer Pricing principles

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answers The and its whollyowned Parent subsidiaries Group constitute the Multinational Introduction ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started