Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are offered an annuity that will pay $24,000 per year for 11 years (the first payment will occur one year from today). If you

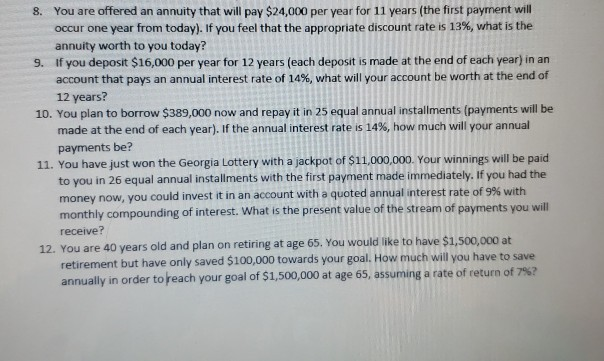

You are offered an annuity that will pay $24,000 per year for 11 years (the first payment will occur one year from today). If you feel that the appropriate discount rate is 13%, what is the annuity worth to you today? if you deposit $16,000 per year for 12 years (each deposit is made at the end of each year) in an account that pays an annual interest rate of 14%, what will your account be worth at the end of 12 years? 8. s. 10. You plan to borrow $389,000 now and repay it in 25 equal annual installments (payments will be made at the end of each year). If the annual interest rate is 14%, how much will your annual payments be? 11. You have just won the Georgia Lottery with a jackpot of $11,000,000 Your winnings will be paid to you in 26 equal annual installments with the first payment made immediately. If you had the money now, you could invest it in an account with a quoted annual interest rate of 9% with monthly compounding of interest. What is the present value of the stream of payments you will receive? 12. You are 40 years old and plan on retiring at age 65. You would like to have $1,500,000 at retirement but have only saved $100,000 towards your goal. How much will you have to save annually in order to reach your goal of $1,500,000 at age 65, assuming a rate of retur n of 7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started