Question

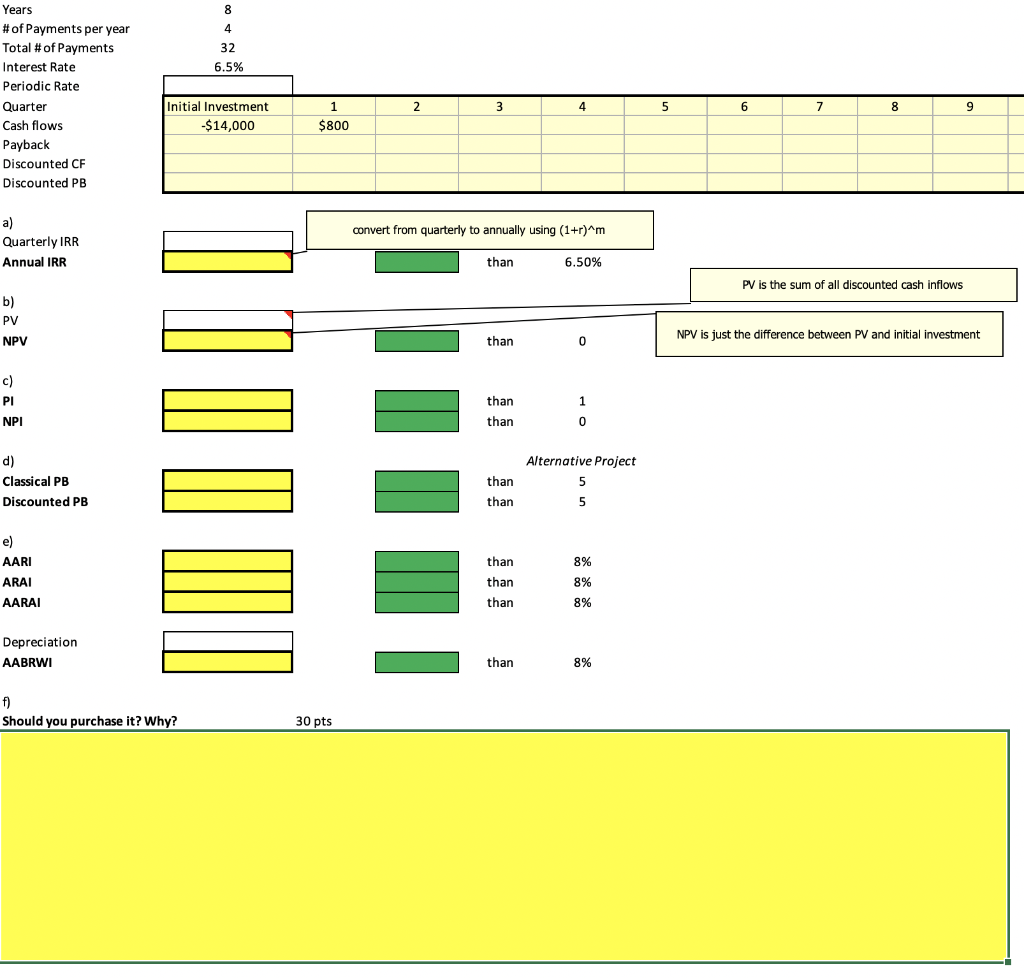

You are offered an asset that costs $14,000 and has cash flows as follows below at the end of each quarter for the next 8years.

You are offered an asset that costs $14,000 and has cash flows as follows below at the end of each quarter for the next 8years. Then it will be sold for $2,500. Your cost of capital is 6.5percent. An alternative (mutually exclusive) project is available which offers an accounting rate of return of 8%, a classical payback period of 5years and a discounted payback period of 5years.

Year 1: $800 each quarter

Year 2: $850 each quarter

Year 3: $850 each quarter

Year 4: $950 each quarter

Year 5: $800 each quarter

Year 6: $600 each quarter

Year 7: $500 each quarter

Year 8: $400 each quarter

a) What is the IRR of the asset?

b) What is the NPV of the asset?

c)What are the PI and NPI of the asset?

d)What are the classical and discounted payback periods?

e) What is the four-accounting rate of returns (utilizing cash flows)?

f) Should you purchase it? Base your answer on your solutions to parts a and b (IRR and NPV) and explain why.

(Please answer using STEP-BY-STEP) (PLEASE USE EXCEL) (Fill the initial investments up to 32 periods)

Years # of Payments per year Total # of Payments Interest Rate Periodic Rate Quarter Cash flows Payback Discounted CF Discounted PB 32 6.5% Initial Investment 4 8 14,000 $800 convert from quarterly to annually using (1+r)*m Quarterly IRR Annual IRR 6.50% than PV is the sum of all discounted cash inflows PV NPV is just the difference between PV and initial investment NPV than than than NPI Alternative Project Classical PB than than Discounted PB 8% 8% 8% AARI ARAI AARA than than than Depreciation AABRWI than 8% 30 pts Should you purchase it? Why? Years # of Payments per year Total # of Payments Interest Rate Periodic Rate Quarter Cash flows Payback Discounted CF Discounted PB 32 6.5% Initial Investment 4 8 14,000 $800 convert from quarterly to annually using (1+r)*m Quarterly IRR Annual IRR 6.50% than PV is the sum of all discounted cash inflows PV NPV is just the difference between PV and initial investment NPV than than than NPI Alternative Project Classical PB than than Discounted PB 8% 8% 8% AARI ARAI AARA than than than Depreciation AABRWI than 8% 30 pts Should you purchase it? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started