Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are paid a 1 1 million advance to write a book. The book took one year to write. In the time you spent writing,

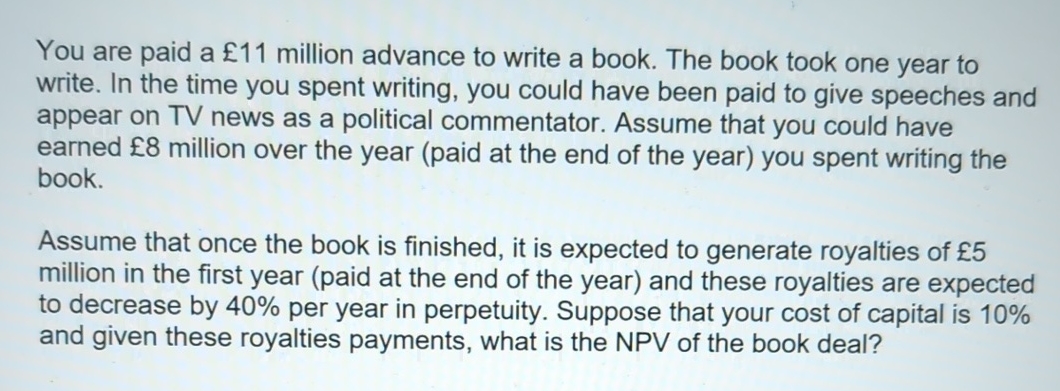

You are paid a million advance to write a book. The book took one year to write. In the time you spent writing, you could have been paid to give speeches and appear on TV news as a political commentator. Assume that you could have earned million over the year paid at the end of the year you spent writing the book.

Assume that once the book is finished, it is expected to generate royalties of million in the first year paid at the end of the year and these royalties are expected to decrease by per year in perpetuity. Suppose that your cost of capital is and given these royalties payments, what is the NPV of the book deal?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started