Question

You are planning to invest in an office building whose current market value is $133,000,000, and it is expected to increase at the inflation

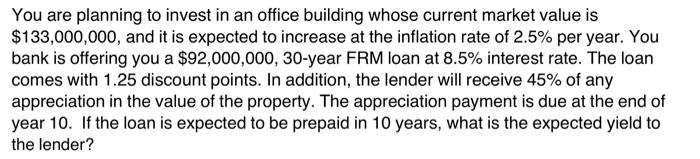

You are planning to invest in an office building whose current market value is $133,000,000, and it is expected to increase at the inflation rate of 2.5% per year. You bank is offering you a $92,000,000, 30-year FRM loan at 8.5% interest rate. The loan comes with 1.25 discount points. In addition, the lender will receive 45% of any appreciation in the value of the property. The appreciation payment is due at the end of year 10. If the loan is expected to be prepaid in 10 years, what is the expected yield to the lender?

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected yield to the lender we need to consider the interest payments received ove...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical Business Statistics

Authors: Andrew Siegel

6th Edition

0123852080, 978-0123852083

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App