Question: You are planning to perform analytical procedures related to inventory fraud, and wish to develop a nonfraud hypothesis (HO) expectation using industry data. Specifically,

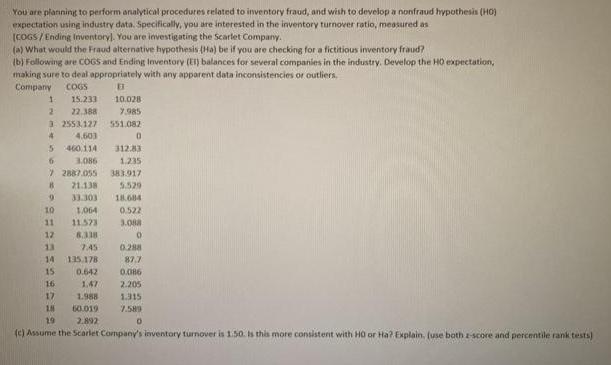

You are planning to perform analytical procedures related to inventory fraud, and wish to develop a nonfraud hypothesis (HO) expectation using industry data. Specifically, you are interested in the inventory turnover ratio, measured as [COGS/Ending Inventory). You are investigating the Scarlet Company. (a) What would the Fraud alternative hypothesis (Ha) be if you are checking for a fictitious inventory fraud? (b) Following are COGS and Ending Inventory (El) balances for several companies in the industry. Develop the HO expectation, making sure to deal appropriately with any apparent data inconsistencies or outliers, Company COGS B 1 2 3 2553127 4 15.233 22.388 4.603 5 460,114 6 3.086 B 9 10 11 12 13 14 15 16 17 1.86 19 10.028 7.985 551.082 72887.055 21.138 33.303 1,064 11.573 8.338 7.45 135.178 0.642 1.47 1.988 60.019 2.892 (c) Assume the Scarlet Company's inventory turnover is 1.50. Is this more consistent with HO or Ha? Explain, (use both z-score and percentile rank tests) 0 312.83 1.235 383.917 5.529 18.684 0.522 3.088 0 0.288 87.7 0.086 2.205 1.315 7.589 0

Step by Step Solution

3.63 Rating (164 Votes )

There are 3 Steps involved in it

a The Fraud alternative hypothesis would be that the Scarlet Company is inflating its inventory in o... View full answer

Get step-by-step solutions from verified subject matter experts