Question

You are planning to purchase a farmhouse in the Gippsland area, as the current property prices are increasing steadily. You have a plan to move

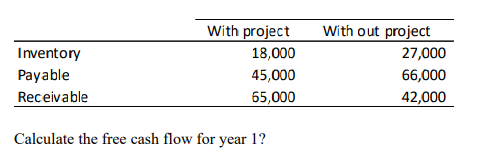

You are planning to purchase a farmhouse in the Gippsland area, as the current property prices are increasing steadily. You have a plan to move in 5 years and the current price of the property is $175000 and according to the current market data the property value is expected to increase by 3% each year. Assume that you can earn 8% from this investment and how much you must invest at the end of each of the next 5 years to reach your goal? (3 Marks) Click or tap here to enter text. b. The recent improvements of your product created a lot of diversification opportunities. The manufacturing head decided to launch a new product range, which will increase the operating profit by $250,000 with an additional depreciation cost of $75,000. The management accountant provides the upcoming years (year 1) changes as follows

How much Alex must deposit annually if he wants to have $800,000 in 25 years by making equal annual end-of-the-year deposits into an account paying 6% interest annually.

With project 18,000 With out project Inventory Payable 45,000 27,000 66,000 42,000 Receivable 65,000 Calculate the free cash flow for year 1? With project 18,000 With out project Inventory Payable 45,000 27,000 66,000 42,000 Receivable 65,000 Calculate the free cash flow for year 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started