Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are preparing the list of Vouchers Payable for your company in anticipation of closing the books on December 31, 2021, your fiscal year

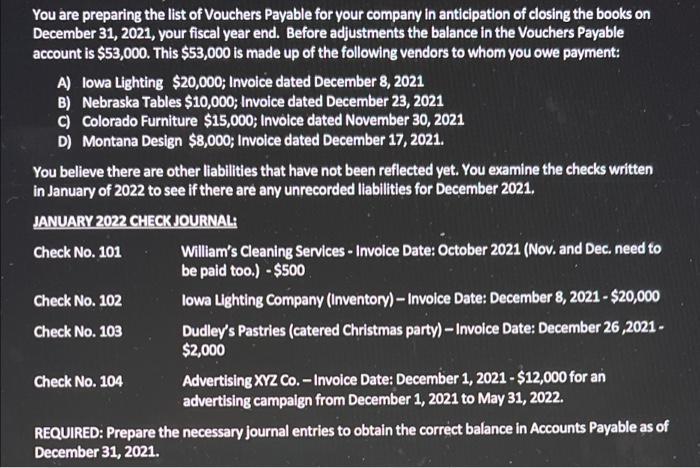

You are preparing the list of Vouchers Payable for your company in anticipation of closing the books on December 31, 2021, your fiscal year end. Before adjustments the balance in the Vouchers Payable account is $53,000. This $53,000 is made up of the following vendors to whom you owe payment: A) lowa Lighting $20,000; Invoice dated December 8, 2021 B) Nebraska Tables $10,000; Invoice dated December 23, 2021 c) Colorado Furniture $15,000; Invoice dated November 30, 2021 D) Montana Design $8,000; Invoice dated December 17, 2021. You believe there are other liabilities that have not been reflected yet. You examine the checks written in January of 2022 to see if there are any unrecorded liabilities for December 2021. JANUARY 2022 CHECK JOURNAL: Check No. 101 Check No. 102 Check No. 103 Check No. 104 William's Cleaning Services - Invoice Date: October 2021 (Nov. and Dec. need to be paid too.) - $500 lowa Lighting Company (Inventory)- Invoice Date: December 8, 2021-$20,000 Dudley's Pastries (catered Christmas party) - Invoice Date: December 26,2021- $2,000 Advertising XYZ Co.-Invoice Date: December 1, 2021-$12,000 for an advertising campaign from December 1, 2021 to May 31, 2022. REQUIRED: Prepare the necessary journal entries to obtain the correct balance in Accounts Payable as of December 31, 2021.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Vouchers Payable A lowa Lighting 20000 Invoice dated D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started