Question

You are presented with the Financial Statements for Trex Company, Inc. Look to Item 15 (beginning on page F-1) to answer the following questions. 1.

You are presented with the Financial Statements for Trex Company, Inc. Look to Item 15 (beginning on page F-1) to answer the following questions.

1. What is the balance of Inventory on December 31, 2011?

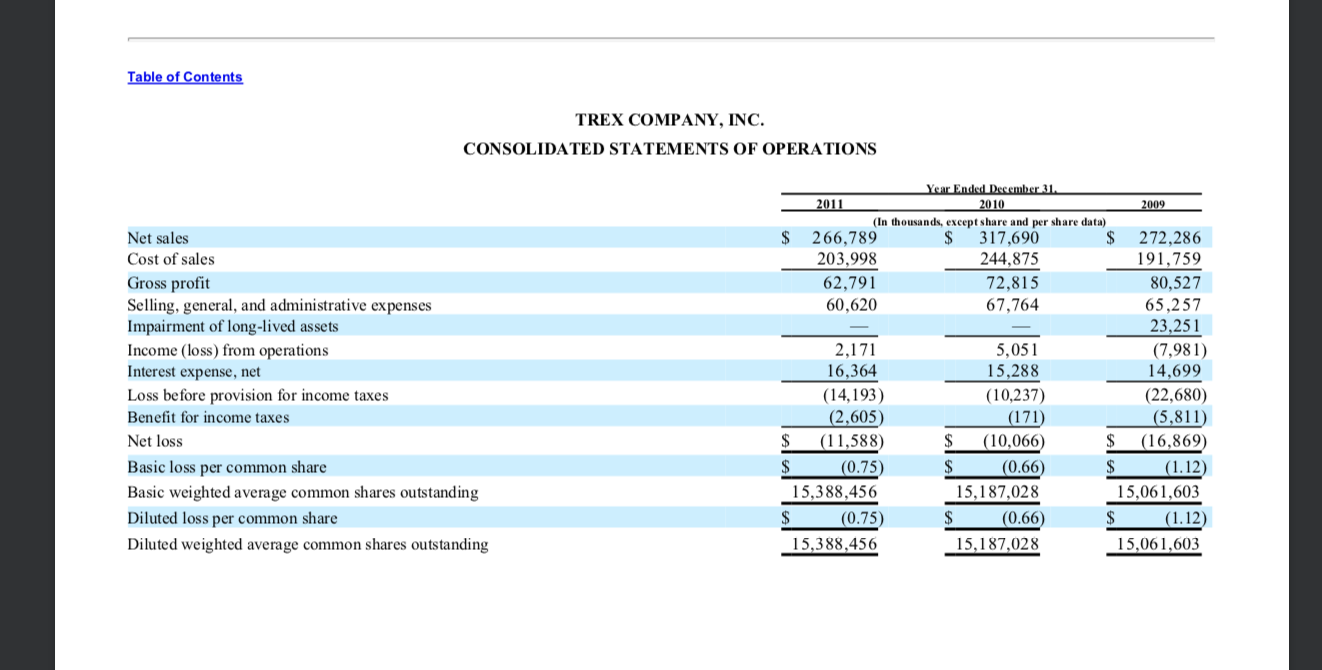

2.What were Cost of Goods Sold for 2011?

3. Which method does Trex use to value inventory on their balance sheet? What are the advantages and disadvantages of using this method?

4. What would inventory and total assets have been if Trex used FIFO costs?

5. What would Costs of Goods Sold have been if Trex used FIFO costs?

6. Calculate Pretax Income for Trex using FIFO costs.

7. Do you think Trex should use FIFO or LIFO to value inventories going forward? Why?7. In 2009, Trex had a liquidation of inventories. What does this mean? Did Trex recognize a loss or a benefit from this and for what amount was the loss/benefit?

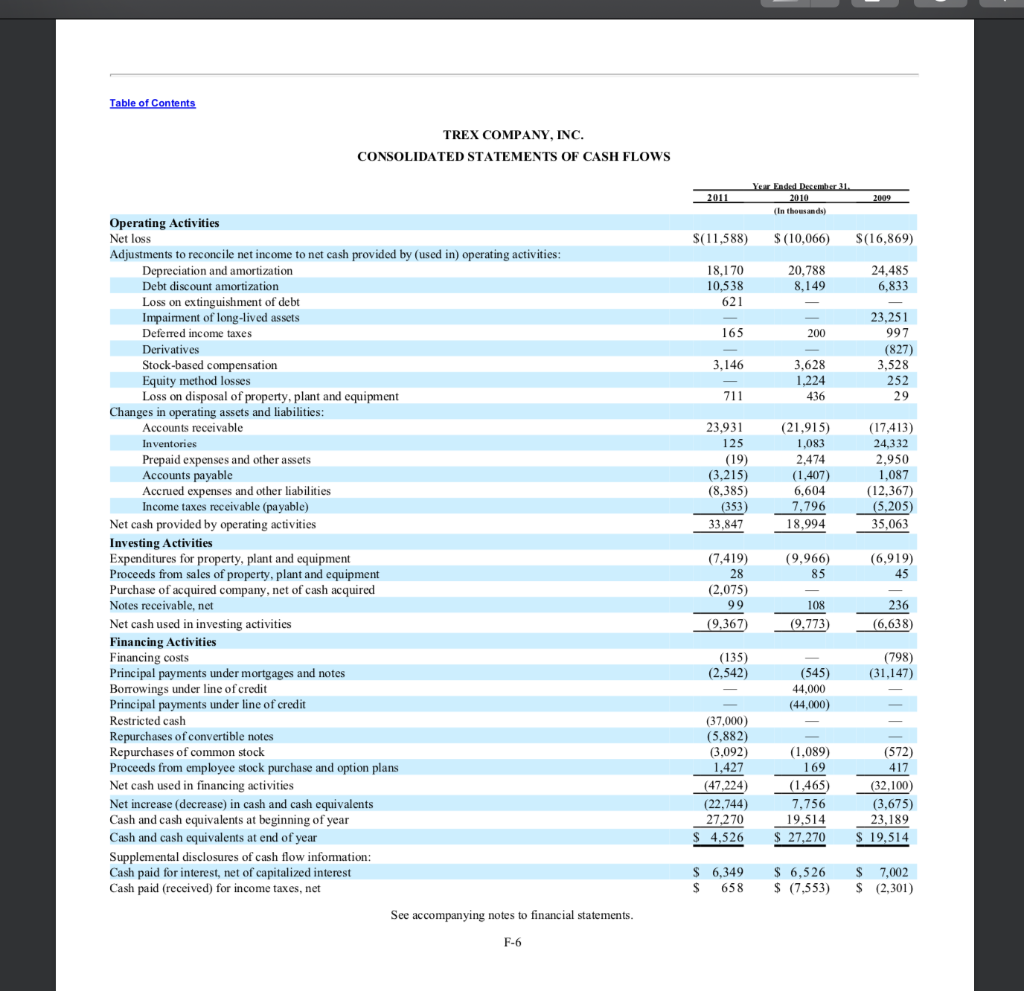

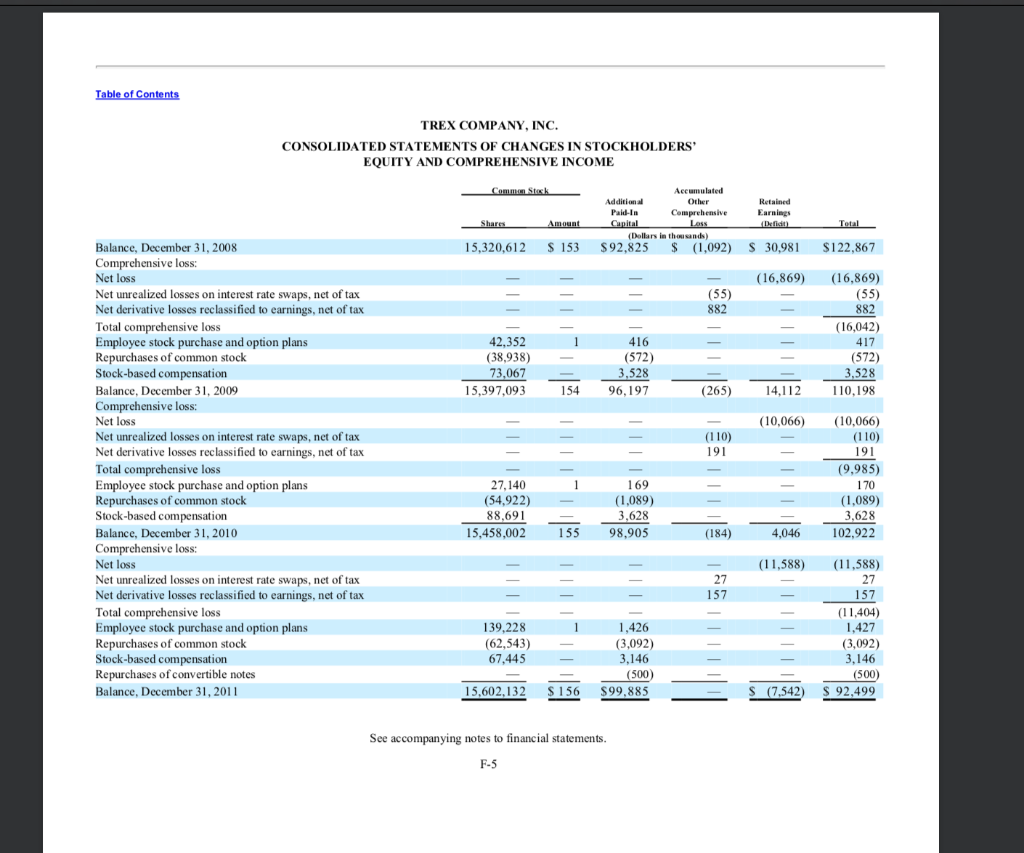

Table of Contents TREX COMPANY, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS 2011 Your Ends December 31 2010 (In thousands 2009 $(11,588) $(10,066) $(16,869) 18.170 10,538 621 20,788 8,149 Operating Activities Net loss Adjustments to reconcile net income to net cash provided by (used in) operating activities: Depreciation and amortization Debt discount amortization Loss on extinguishment of debt Impairment of long-lived assets Deferred income taxes co Derivatives Stock-based compensation 24,485 6,833 165 200 23,251 997 (827) 3,528 252 29 3,146 Equity Seouity method losses 3,628 1,224 436 711 23,931 125 (19) (3,215) (8,385) (353) (21,915) 1,083 2,474 (1,407) 6,604 7,796 (17,413) 24,332 2,950 1,087 (12.367) (5,205) 33,847 18,994 35,063 (9,966) 85 (6,919) 45 (7,419) 28 (2,075) 99 (9,367 108 (9.773 236 (6,638) Loss on disposal of property, plant and equipment Changes operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other assets Accounts payable Accrued expenses and other liabilities Income taxes receivable (payable) Net cash provided by operating activities Investing Activities Expenditures for property, plant and equipment Proceeds from sales of property, plant and equipment Purchase of acquired company, net of cash acquired Notes receivable, net Net cash used in investing activities Financing Activities Financing costs principal payments under mortgages and notes Borrowings under line of credit Principal payments under line of credit Restricted cash Repurchases of convertible notes Repurchases of common stock Proceeds from employee stock purchase and option plans Net cash used in financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental disclosures of cash flow information: Cash paid for interest, net of capitalized interest Cash paid (received) for income taxes, net (135) (2,542) (798) (31,147) (545) 44,000 (44,000) (37.000) (5,882) (3,092) 1,427 (47.224 (22,744) 27,270 $ 4,526 (1,089) 169 (1.465) 7.756 19,514 27,270 (572) 417 (32.100 (3,675) 23,189 : 19,514 $ 6,349 S 658 $ 6,526 $ (7,553) $ 7,002 $ (2,301) See accompanying notes to financial statements. F-6 Table of Contents TREX COMPANY, INC. CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY AND COMPREHENSIVE INCOME Common Stask Additional Paid in Accumulated Other Comprehensive Retained Earnings Shares Amount 15,320,612 $ 153 (Dollars in thousands) $92,825 $ (1,092) $ 30,981 $122,867 (16,869) (55) 882 (16,869) (55) 882 (16,042) Employee stock 42,352 (38,938) 73,067 15,397,093 416 (572) 3,528 96,197 417 (572) 3,528 110,198 154 (265) 14,112 (10,066) (110) 191 (10,066) (110) 191 Balance, December 31, 2008 Comprehensive loss Net loss Net unrealized losses on interest rate swaps, net of tax Net derivative losses reclassified to earnings, net of tax Total comprehensive loss stock purchase and option plans Repurchases of common stock Stock-based compensation Balance, December 31, 2009 Comprehensive loss Net loss Net unrealized losses on interest rate swaps, net of tax Net derivative losses reclassified to earnings, net of tax Total comprehensive loss Employee stock purchase and option plans Repurchases of common stock Stock-based compensation Balance, December 31, 2010 Comprehensive loss Net loss Net unrealized losses on interest rate swaps, net of tax Net derivative losses reclassified to earnings, net of tax Total comprehensive loss Employee stock purchase and option plans Repurchases of common stock Stock-based compensation Repurchases of convertible notes Balance, December 31, 2011 (9,985) 1 27,140 (54,922) 88,691 15,458,002 169 (1,089) 3,628 98,905 170 (1,089) 3,628 102,922 155 155 (184) 4.046 (11,588) 27 157 139,228 (62,543) 67,445 1,426 (3,092) 3.146 (500) $99.885 (11,588) 27 157 (11.404) 1,427 (3,092) 3,146 (500) $ 92,499 15,602,132 $ 156 1 $ (7.542 S (7,542 See accompanying notes to financial statements F-5 Table of Contents TREX COMPANY, INC. CONSOLIDATED STATEMENTS OF OPERATIONS Net sales Cost of sales Gross profit Selling, general, and administrative expenses Impairment of long-lived assets Income (loss) from operations Interest expense, net Loss before provision for income taxes Benefit for income taxes Net loss Basic loss per common share Basic weighted average common shares outstanding Diluted loss per common share Diluted weighted average common shares outstanding Year Ended December 31 2011 2010 2009 (In thousands, except share and per share data) $ 266,789 317,690 $ 272,286 203,998 244,875 191,759 62,791 72,815 80,527 60,620 67,764 65,257 23,251 2,171 5.051 (7,981) 16,364 15,288 14,699 (14,193) (10,237) (22,680) (2,605) (171) (5,811) $ (11,588) $ (10,066) $ (16,869) $ (0.75) $ (0.66) $ (1.12) 15,388,456 15,187,028 15,061,603 $ (0.75) $ (0.66) $ (1.12) 15,388,456 15,187,028 15,061,603 Table of Contents TREX COMPANY, INC. CONSOLIDATED BALANCE SHEETS Desember 11 2011 2010 In thousands) $ 27,270 $ 4,526 37,000 29,192 28,896 2.118 322 102,054 115.212 10.558 266 $ 228,090 53,332 29,021 1,539 70 1,004 112,236 126,857 6,837 1.885 $ 247,815 ASSETS Current Assets: Cash and cash equivalents Restricted cash Accounts receivable (net of allowance for doubtful accounts of $0.3 million at December 31, 2011 and 2010) Inventories Prepaid expenses and other assets Income taxes receivable Deferred income taxes Total current assets Property, plant and equipment, net Goodwill Other assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable Accrued expenses Accrued warranty Deferred income taxes Current portion of long-term debt Total current liabilities Deferred income taxes Accrued taxes Non-current accrued warranty Debt-related derivative Long-term debt Other long-term liabilities Total Liabilities Commitments and contingencies Stockholders' Equity: Preferred stock, $0.01 par value, 3,000,000 shares authorized; none issued and outstanding Common stock, s0.01 par value, 40,000,000 shares authorized; 15,602,132 and 15,458,002 shares issued and outstanding at December 31, 2011 and 2010, respectively Additional paid-in capital Accumulated other comprehensive loss Retained earnings (deficit) Total Stockholders' Equity Total Liabilities and Stockholders' Equity $ 11,892 16,187 6,000 124 86,425 $ 15,107 23,479 7,003 590 46,179 3,614 3.126 120.628 2,819 60 10,345 7,469 312 84,193 1,739 135,591 144,893 156 99,885 155 98.905 (184) (7,542) 92,499 4,046 102,922 $ 228,090 S 247,815 See accompanying notes to financial statements. F-3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started