Answered step by step

Verified Expert Solution

Question

1 Approved Answer

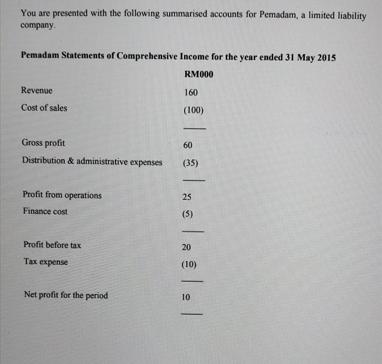

You are presented with the following summarised accounts for Pemadam, a limited liability company. Pemadam Statements of Comprehensive Income for the year ended 31

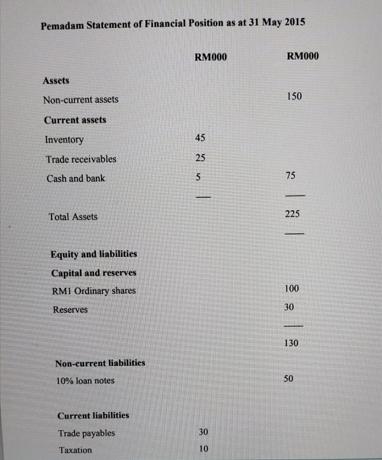

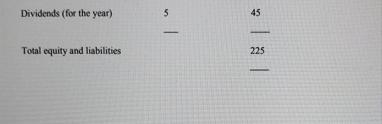

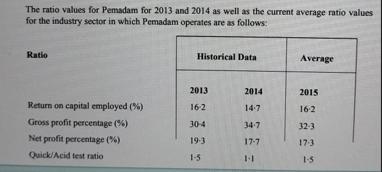

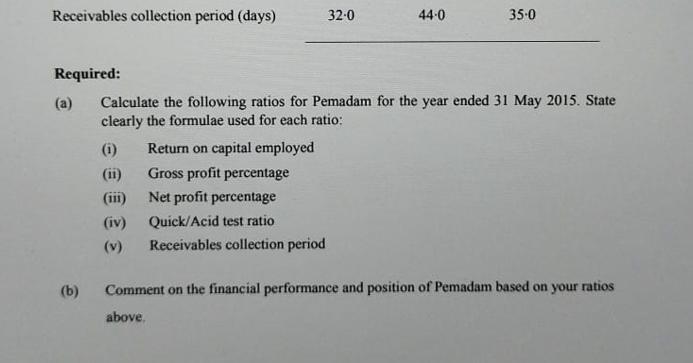

You are presented with the following summarised accounts for Pemadam, a limited liability company. Pemadam Statements of Comprehensive Income for the year ended 31 May 2015 RM000 Revenue Cost of sales Profit from operations Finance cost Gross profit Distribution & administrative expenses (35) Profit before tax Tax expense 160 (100) Net profit for the period | s | as a l (10) Pemadam Statement of Financial Position as at 31 May 2015 Assets Non-current assets Current assets Inventory Trade receivables Cash and bank Total Assets Equity and liabilities Capital and reserves RMI Ordinary shares Reserves Non-current liabilities 10% loan notes Current liabilities Trade payables Taxation RM000 45 25 5 | 30 10 RM000 150 75 225 100 30 130 50 Dividends (for the year) Total equity and liabilities. nl 5 45 225 The ratio values for Pemadam for 2013 and 2014 as well as the current average ratio values for the industry sector in which Pemadam operates are as follows: Ratio Return on capital employed (%) Gross profit percentage (%) Net profit percentage (%) Quick/Acid test ratio Historical Data 2013 16-2 30-4 19-3 1-5 2014 14-7 34-7 17-7 1-1 Average 2015 16-2 32-3 17-3 1-5 Receivables collection period (days) Required: (a) (b) (1) (11) (111) (iv) (v) 32-0 Return on capital employed Gross profit percentage Net profit percentage Quick/Acid test ratio Receivables collection period 44-0 Calculate the following ratios for Pemadam for the year ended 31 May 2015. State clearly the formulae used for each ratio: 35-0 Comment on the financial performance and position of Pemadam based on your ratios above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a Calculation of ratios for Pemadam for the year ended 31 May 2015 1 Return on capital employed Return on capital employed Profit before tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started