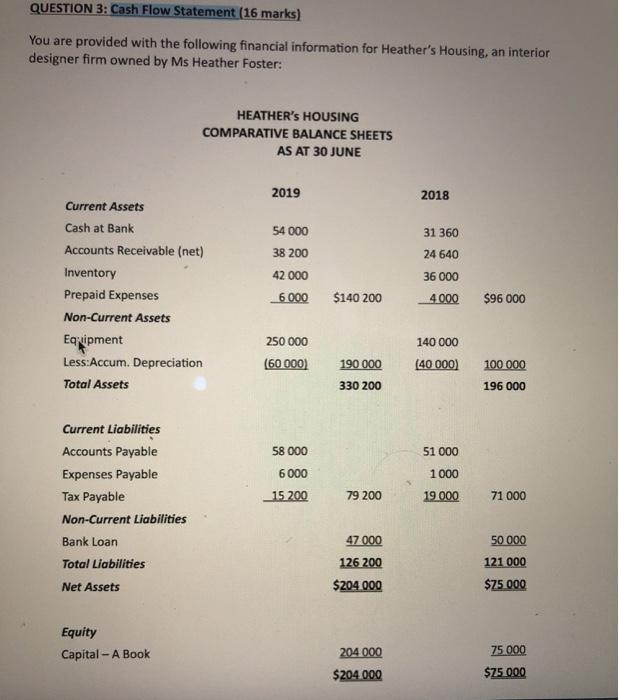

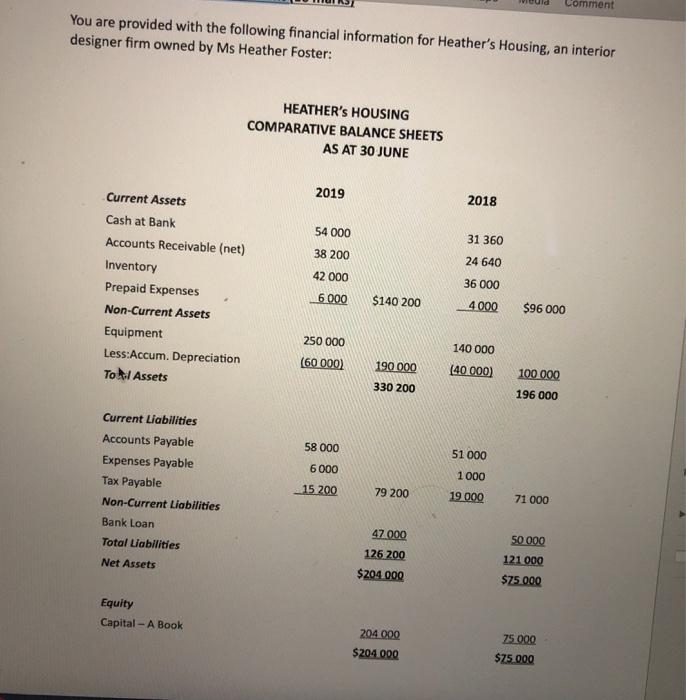

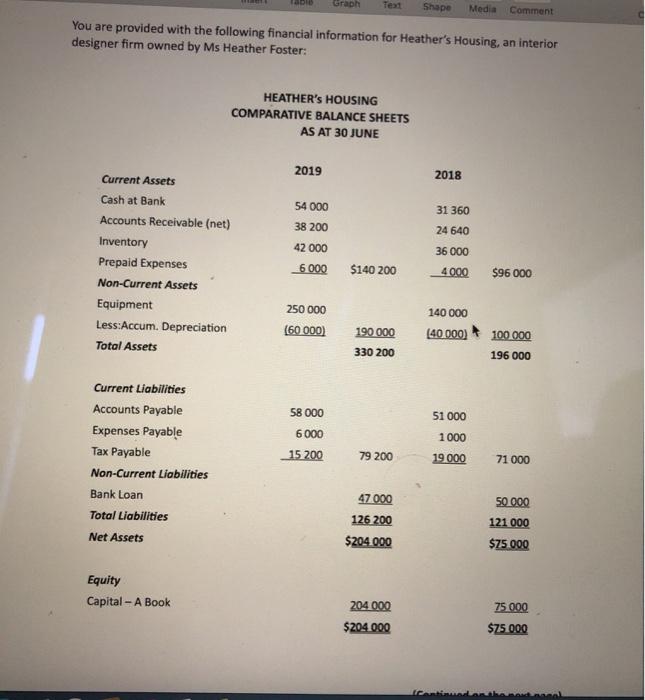

You are provided with the following financial information for Heather's Housing, an interior designer firm owned by Ms Heather Foster: HEATHER's HOUSING COMPARATIVE BALANCE SHEETS AS AT 30 JUNE 2019 2018 Current Assets Cash at Bank 54 000 31 360 Accounts Receivable (net) 38 200 24 640 Inventory 42 000 36 000 Prepaid Expenses 6 000 $140 200 4 000 $96 000 Non-Current Assets Equipment 250 000 140 000 Less:Accum. Depreciation (60 000) 190 000 (40 000) 100 000 Togl Assets 330 200 196 000 Current Liabilities Accounts Payable 58 000 51 000 Expenses Payable 6 000 1 000 Tax Payable 15 200 79 200 19 000 71 000 Non-Current Liabilities Bank Loan 47 000 50 000 Total Liabilities 126 200 121 000 Net Assets $204 000 $75 000 Equity Capital A Book 204 000 75 000 $204 000 $75 000

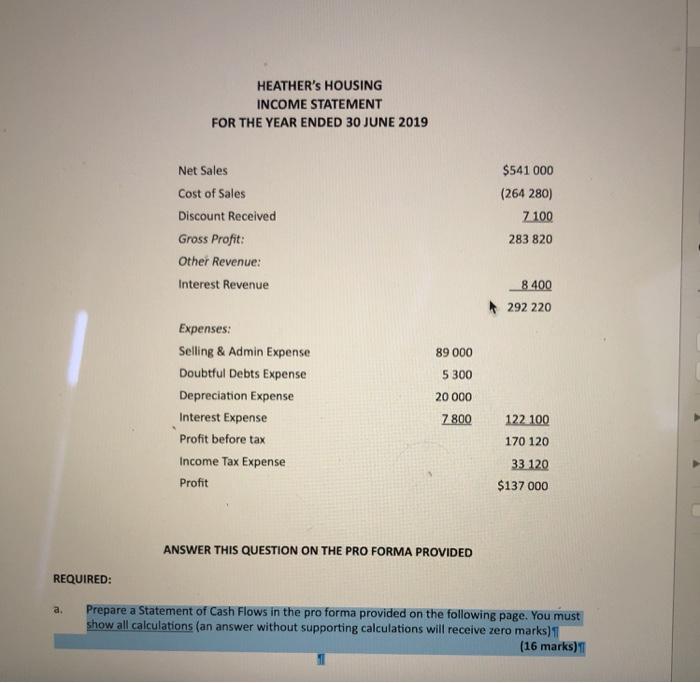

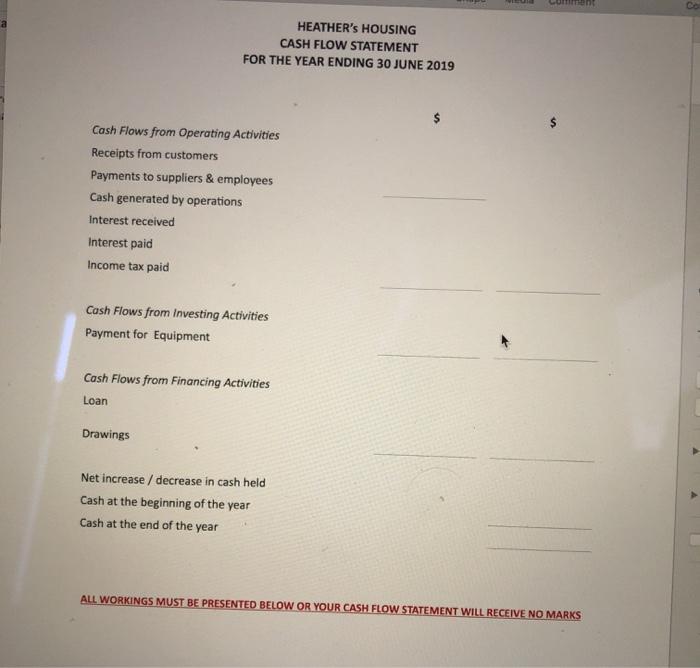

QUESTION 3: Cash Flow Statement (16 marks) You are provided with the following financial information for Heather's Housing an interior designer firm owned by Ms Heather Foster: HEATHER'S HOUSING COMPARATIVE BALANCE SHEETS AS AT 30 JUNE 2019 2018 54 000 31 360 38 200 24 640 Current Assets Cash at Bank Accounts Receivable (net) Inventory Prepaid Expenses Non-Current Assets Equipment Less:Accum. Depreciation Total Assets 42 000 6 000 36 000 4000 $140 200 $96 000 250 000 (60 000) 140 000 (40 000) 190 000 100 000 330 200 196 000 58 000 51 000 1000 6000 15200 79 200 19.000 71 000 Current Liabilities Accounts Payable Expenses Payable Tax Payable Non-Current Liabilities Bank Loan Total Liabilities Net Assets 47 000 126 200 50 000 121 000 $25.000 $204 000 Equity Capital - A Book 204 000 75 000 $25.000 $204 000 Comment You are provided with the following financial information for Heather's Housing an interior designer firm owned by Ms Heather Foster: HEATHER'S HOUSING COMPARATIVE BALANCE SHEETS AS AT 30 JUNE 2019 2018 54 000 31 360 38 200 24 640 42 000 Current Assets Cash at Bank Accounts Receivable (net) Inventory Prepaid Expenses Non-Current Assets Equipment Less:Accum. Depreciation TO M Assets 36 000 6 000 $140 200 4000 $96 000 250 000 (60 000) 140 000 190 000 330 200 (40 000) 100 000 196 000 Current Liabilities 58 000 51 000 Accounts Payable Expenses Payable Tax Payable Non-Current Liabilities 6 000 1000 -15 200 79 200 19 000 71 000 Bank Loan 47000 Total Liabilities Net Assets 126 200 50.000 121 000 $25.000 $204 000 Equity Capital - A Book 204 000 $204 000 75 000 $75.000 Graph Shape Media Comment You are provided with the following financial information for Heather's Housing an interior designer firm owned by Ms Heather Foster: HEATHER'S HOUSING COMPARATIVE BALANCE SHEETS AS AT 30 JUNE 2019 2018 54 000 31 360 38 200 24 640 Current Assets Cash at Bank Accounts Receivable (net) Inventory Prepaid Expenses Non-Current Assets Equipment Less:Accum. Depreciation Total Assets 42 000 6 000 $140 200 36 000 4000 $96 000 250 000 (60 000) 190.000 330 200 140 000 (40000) 100 000 196 000 58 000 51 000 1000 Current Liabilities Accounts Payable Expenses Payable Tax Payable Non-Current Liabilities Bank Loan Total Liabilities 6 000 15 200 79 200 19.000 71 000 47 000 126 200 $204 000 50 000 121 000 $75 000 Net Assets Equity Capital - A Book 204 000 $204.000 75 000 $75 000 caution that HEATHER'S HOUSING INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2019 $541 000 (264 280) 7 100 Net Sales Cost of Sales Discount Received Gross Profit: Other Revenue: Interest Revenue 283 820 8 400 292 220 89 000 5 300 20 000 Expenses: Selling & Admin Expense Doubtful Debts Expense Depreciation Expense Interest Expense Profit before tax Income Tax Expense Profit 7 800 122 100 170 120 33 120 $137 000 ANSWER THIS QUESTION ON THE PRO FORMA PROVIDED REQUIRED: a. Prepare a Statement of Cash Flows in the pro forma provided on the following page. You must show all calculations (an answer without supporting calculations will receive zero marks) 1 (16 marks) LO HEATHER'S HOUSING CASH FLOW STATEMENT FOR THE YEAR ENDING 30 JUNE 2019 $ Cash Flows from Operating Activities Receipts from customers Payments to suppliers & employees Cash generated by operations Interest received Interest paid Income tax paid Cash Flows from Investing Activities Payment for Equipment Cash Flows from Financing Activities Loan Drawings Net increase / decrease in cash held Cash at the beginning of the year Cash at the end of the year ALL WORKINGS MUST BE PRESENTED BELOW OR YOUR CASH FLOW STATEMENT WILL RECEIVE NO MARKS