Answered step by step

Verified Expert Solution

Question

1 Approved Answer

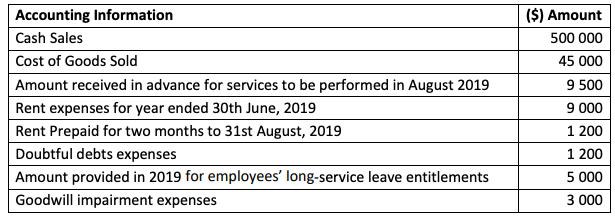

You are provided with the following information from the accounts of KPM Ltd for the year ending 30th June, 2019, as shown in the table

You are provided with the following information from the accounts of KPM Ltd for the year ending 30th June, 2019, as shown in the table below:

b) NRP Ltd has the following deferred tax balances as at 30th June, 2019. Deferred tax asset $8 00 000 Deferred tax liability $6 00 000 The above balances were calculated when the tax rate, was 20 per cent. On 1st December, 2019 the government raises the corporate tax rate to 25 per cent.

c)Need the journal entries to adjust the carry-forward balances of the deferred tax asset and deferred tax liability.

Accounting Information Cash Sales Cost of Goods Sold Amount received in advance for services to be performed in August 2019 Rent expenses for year ended 30th June, 2019 Rent Prepaid for two months to 31st August, 2019 Doubtful debts expenses Amount provided in 2019 for employees' long-service leave entitlements Goodwill impairment expenses ($) Amount 500 000 45 000 9 500 9 000 1 200 1 200 5 000 3 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the taxable profit and accounting profit for the year ending 30th June 2019 we need to consider the given accounting information a Taxabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started