Answered step by step

Verified Expert Solution

Question

1 Approved Answer

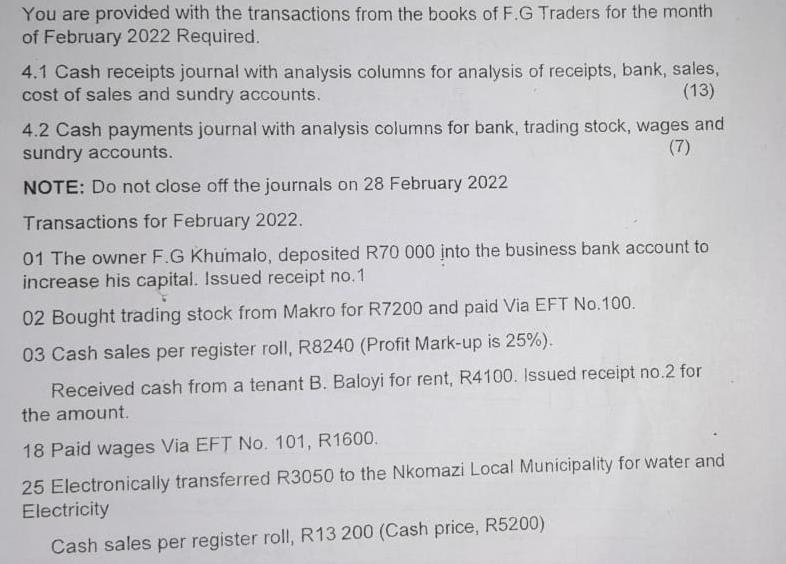

You are provided with the transactions from the books of F.G Traders for the month of February 2022 Required. 4.1 Cash receipts journal with

You are provided with the transactions from the books of F.G Traders for the month of February 2022 Required. 4.1 Cash receipts journal with analysis columns for analysis of receipts, bank, sales, cost of sales and sundry accounts. (13) 4.2 Cash payments journal with analysis columns for bank, trading stock, wages and sundry accounts. NOTE: Do not close off the journals on 28 February 2022 Transactions for February 2022. (7) 01 The owner F.G Khumalo, deposited R70 000 into the business bank account to increase his capital. Issued receipt no.1 02 Bought trading stock from Makro for R7200 and paid Via EFT No.100. 03 Cash sales per register roll, R8240 (Profit Mark-up is 25%). Received cash from a tenant B. Baloyi for rent, R4100. Issued receipt no.2 for the amount. 18 Paid wages Via EFT No. 101, R1600. 25 Electronically transferred R3050 to the Nkomazi Local Municipality for water and Electricity Cash sales per register roll, R13 200 (Cash price, R5200)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started