Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are recently hired as an investigative analyst at Krystalclear Research Pty Ltd. The company conducts due diligence research on published accounts of public

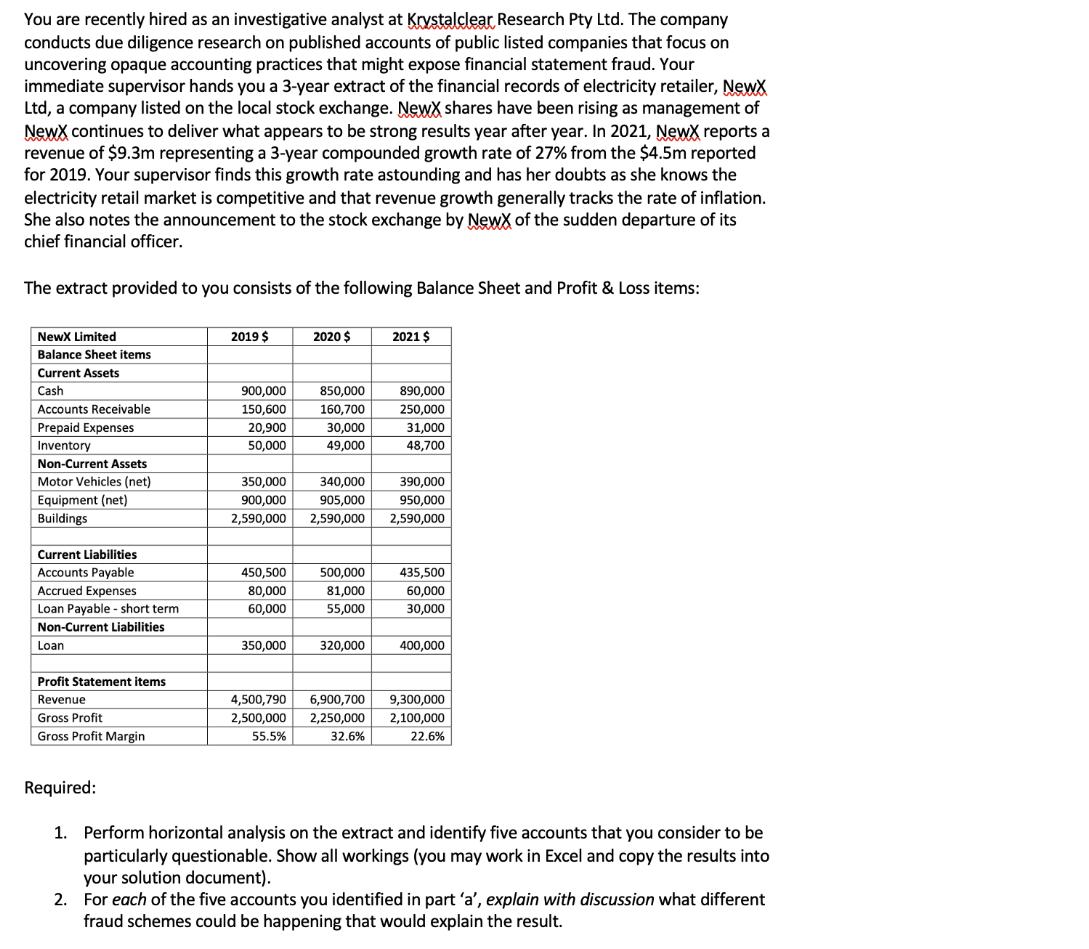

You are recently hired as an investigative analyst at Krystalclear Research Pty Ltd. The company conducts due diligence research on published accounts of public listed companies that focus on uncovering opaque accounting practices that might expose financial statement fraud. Your immediate supervisor hands you a 3-year extract of the financial records of electricity retailer, NewX Ltd, a company listed on the local stock exchange. NewX shares have been rising as management of NewX continues to deliver what appears to be strong results year after year. In 2021, NewX reports a revenue of $9.3m representing a 3-year compounded growth rate of 27% from the $4.5m reported for 2019. Your supervisor finds this growth rate astounding and has her doubts as she knows the electricity retail market is competitive and that revenue growth generally tracks the rate of inflation. She also notes the announcement to the stock exchange by NewX of the sudden departure of its chief financial officer. The extract provided to you consists of the following Balance Sheet and Profit & Loss items: NewX Limited Balance Sheet items Current Assets Cash Accounts Receivable Prepaid Expenses Inventory Non-Current Assets Motor Vehicles (net) Equipment (net) Buildings Current Liabilities Accounts Payable Accrued Expenses Loan Payable - short term Non-Current Liabilities Loan Profit Statement items Revenue Gross Profit Gross Profit Margin 2019 $ 900,000 150,600 20,900 50,000 450,500 80,000 60,000 2020 $ 350,000 350,000 340,000 390,000 900,000 905,000 950,000 2,590,000 2,590,000 2,590,000 850,000 890,000 160,700 250,000 30,000 31,000 49,000 48,700 2021 $ 500,000 81,000 55,000 320,000 435,500 60,000 30,000 400,000 4,500,790 6,900,700 9,300,000 2,500,000 2,250,000 2,100,000 55.5% 32.6% 22.6% Required: 1. Perform horizontal analysis on the extract and identify five accounts that you consider to be particularly questionable. Show all workings (you may work in Excel and copy the results into your solution document). 2. For each of the five accounts you identified in part 'a', explain with discussion what different fraud schemes could be happening that would explain the result.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started