Question

You are recently hired by a hedge fund named SSG Investments. You decide to use 100 futures contracts to hedge an exposure to the

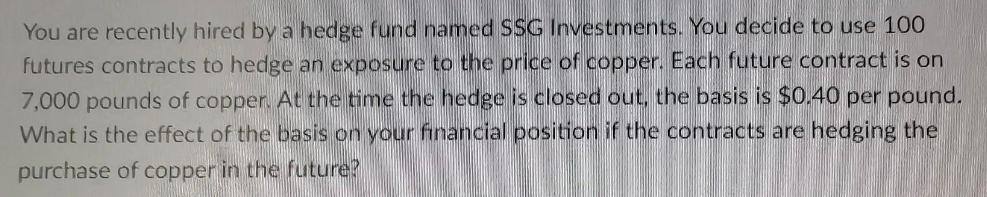

You are recently hired by a hedge fund named SSG Investments. You decide to use 100 futures contracts to hedge an exposure to the price of copper. Each future contract is on 7,000 pounds of copper. At the time the hedge is closed out, the basis is $0.40 per pound. What is the effect of the basis on your financial position if the contracts are hedging the purchase of copper in the future?

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

A positive basis in this scenario benefits your financial position if the contracts are hedging the purchase of copper in the future Heres why BasisTh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Valuation The Art and Science of Corporate Investment Decisions

Authors: Sheridan Titman, John D. Martin

3rd edition

133479528, 978-0133479522

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App